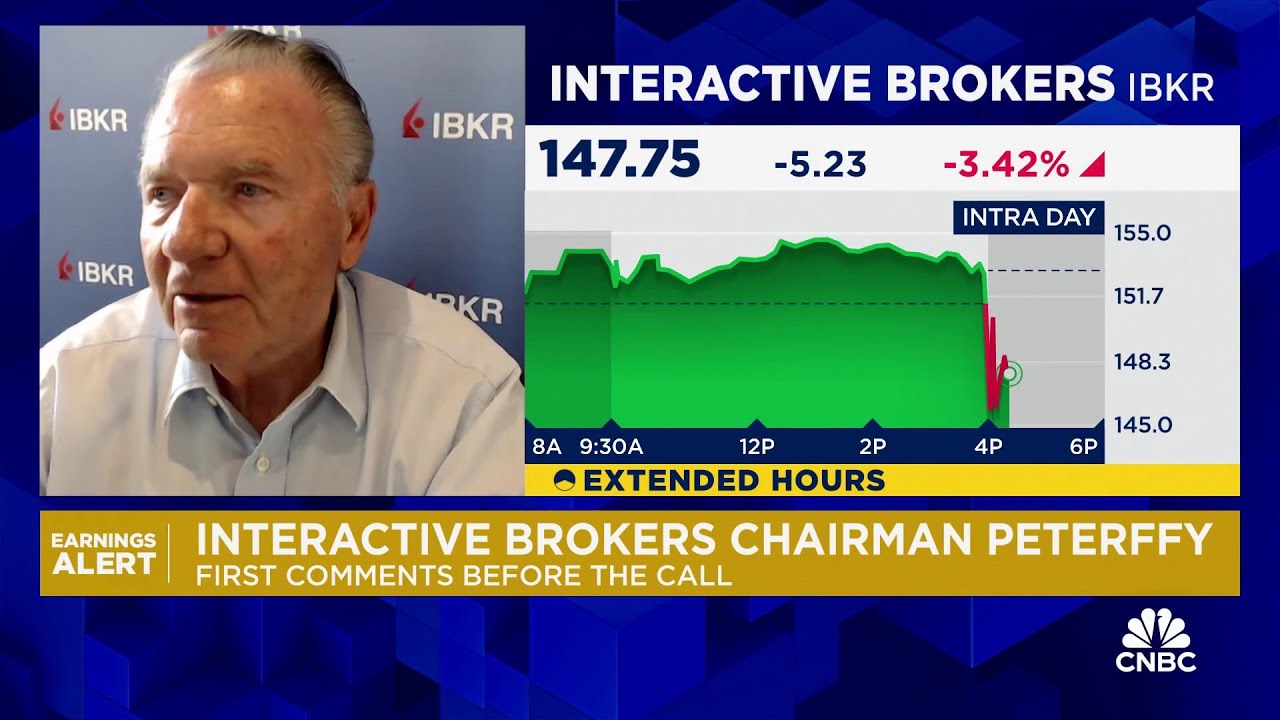

In an interview, Interactive Brokers Chairman Thomas Peterffy highlighted the company’s strong financial performance, driven by a 28% increase in customer accounts and a 31% rise in commission revenue, while expressing confusion over the sustained excitement in trading, largely fueled by artificial intelligence and abundant capital in the economy. He also discussed the implications of interest rate changes on the firm’s profitability and noted the growing interest in election-related trading as a potential hedge for investors.

In an exclusive interview, Thomas Peterffy, Chairman and Founder of Interactive Brokers, discussed the company’s impressive financial performance, highlighting a 28% increase in customer accounts and a 31% rise in commission revenue. He noted that customer margin loans also rose by 28%, indicating a robust trading environment. Despite the ongoing enthusiasm for trading, Peterffy expressed his confusion about the sustained interest, suggesting that the excitement surrounding artificial intelligence (AI) and the abundance of money in the economy are significant factors driving this trend.

Peterffy acknowledged that the ongoing excitement around AI seems never-ending, contributing to the high levels of trading activity. He pointed out that with so much capital in the economy, investors are seeking opportunities, which is likely fueling their trading behavior. This environment has proven profitable for Interactive Brokers, as increased trading activity translates to higher revenues for the firm.

When discussing net interest income, which increased by 9% in the quarter, Peterffy shared his perspective on the Federal Reserve’s decision to cut interest rates. He indicated that while lower rates may benefit the broader economy, they are not advantageous for his firm, which profits more from higher interest rates. He expressed skepticism about the extent to which rates will be cut, citing concerns over inflation that could limit the Fed’s ability to lower rates significantly.

The conversation also touched on election-related trading activity, with Peterffy noting the fluctuations in betting odds for candidates as the election approaches. He observed that recent trends showed a shift in favor of Trump, highlighting the dynamic nature of political betting. This new product has generated interest among traders, particularly as they engage with swing state races and other political contests.

Finally, Peterffy suggested that election betting could serve as a hedge for investors, allowing them to manage their exposure based on their stock portfolios. He believes that this feature may attract individuals who are not typically active in stock trading but possess strong political insights. Overall, the interview underscored the ongoing excitement in trading, the implications of interest rate changes, and the potential for political betting to engage a broader audience on the Interactive Brokers platform.