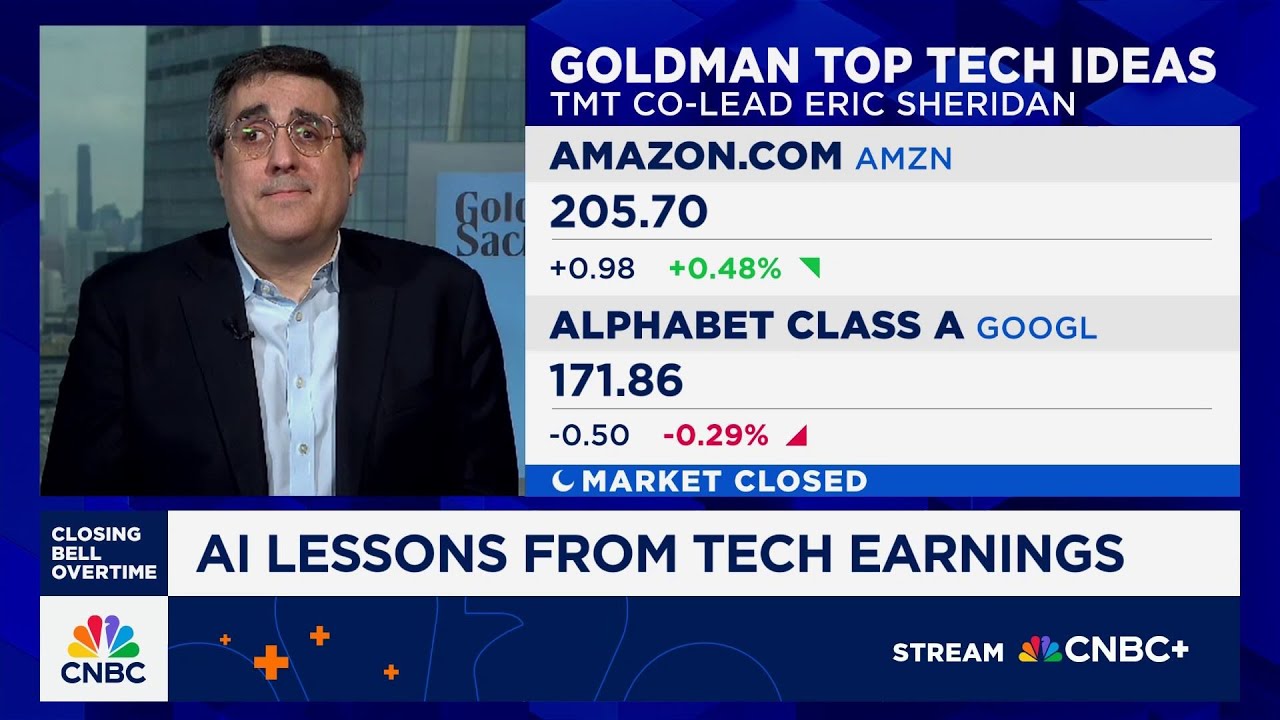

Eric Sheridan from Goldman Sachs states that AI trade is still evolving, with ongoing significant investments by major tech companies indicating a robust and expanding AI sector. Despite cautious market reactions and economic uncertainties, he emphasizes that AI development is shifting from infrastructure to innovative applications, driving future growth in the tech industry.

In the interview, Eric Sheridan from Goldman Sachs discusses the current state and future prospects of the technology sector, emphasizing that AI trade remains a work in progress. He notes that corporate earnings expectations have shifted over recent weeks, with initial low expectations leading to positive reactions when companies beat forecasts. However, as expectations have risen, the hurdles for companies to meet or exceed guidance have become higher, making investor sentiment more cautious, especially given the current global economic uncertainties.

Sheridan highlights that despite some cautious guidance from companies, the overall environment remains stable, particularly at the high end of the digital consumer market. The AI sector continues to be a significant driver of capital expenditure (CapEx), with ongoing deployment of AI technologies both at the enterprise and consumer levels. Recent events, such as Alphabet’s Google I/O, showcased continued innovation and broader adoption of AI, reinforcing the theme that AI investment and development are still robust and expanding.

The conversation touches on the market’s reaction to cautious guidance, often seen as a buying opportunity if visibility into future performance improves. Sheridan explains that low visibility, especially regarding tariffs and global trade dynamics, contributes to investor caution. However, as more data and clarity emerge over time, these cautious signals tend to turn into opportunities for investors, provided the macroeconomic and geopolitical uncertainties can be better understood and managed.

Regarding the AI trade’s sustainability, Sheridan points out that major tech companies like Amazon, Alphabet, and Meta are all increasing their CapEx guidance, indicating ongoing investment in AI infrastructure and applications. He emphasizes that the buildout of AI capabilities is unlikely to slow down in the near term, with companies continuing to invest heavily in expanding their AI platforms and technologies throughout the year. This sustained investment underscores the belief that AI remains a key growth driver in the tech sector.

Finally, Sheridan discusses the evolution of the tech stack, noting that the industry is moving from infrastructure towards more application and platform development. He draws parallels with previous computing cycles, where initial infrastructure investments eventually give way to innovative applications and platforms that drive user engagement and new business models. Currently, significant innovation is happening at the application layer, with companies like Google, OpenAI, and Anthropic pushing the boundaries of what AI-powered applications can achieve, signaling a promising future for AI-driven growth in the tech industry.