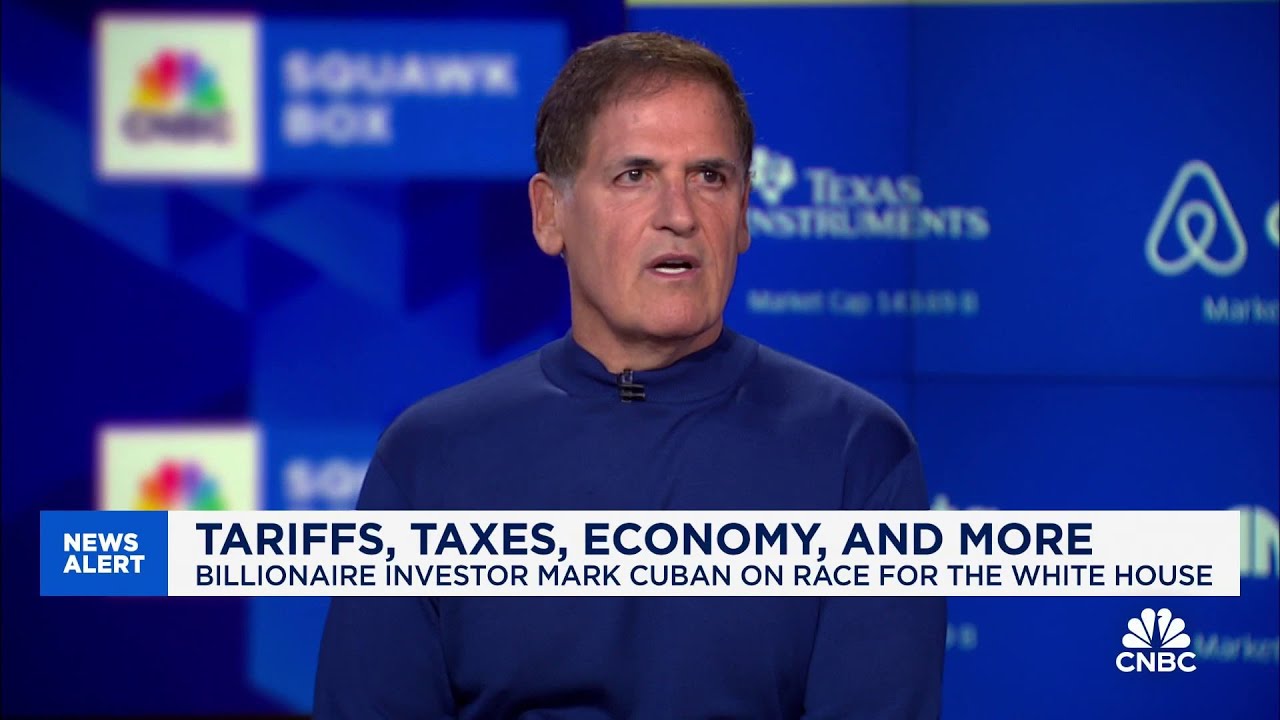

Billionaire investor Mark Cuban emphasized the necessity of investing in artificial intelligence (AI) for the U.S. to maintain its global leadership and military strength, advocating for increased funding from both private companies and the Department of Defense. He also discussed economic issues, suggesting that taxing stock buybacks could incentivize corporate reinvestment and improve the economy, while criticizing current political candidates for failing to address the national debt and deficit effectively.

In a recent discussion, billionaire investor Mark Cuban emphasized the critical importance of investing in artificial intelligence (AI) for the United States’ global standing and military dominance. He argued that the nation’s ability to lead in AI technology directly correlates with its military strength, suggesting that whoever excels in AI will have a significant advantage in military capabilities. Cuban highlighted the need for both private companies and the Department of Defense to increase their investments in AI to maintain this competitive edge.

The conversation also touched on the political landscape, particularly regarding candidates’ approaches to economic issues like the national debt and deficit. Cuban pointed out that neither candidate adequately addresses these concerns, leading to a competition over who can promise more without considering the fiscal implications. He criticized the lack of straightforward discussions about raising corporate taxes, suggesting that a tax on stock buybacks could generate significant revenue to help reduce the deficit.

Cuban proposed that taxing stock buybacks could change corporate behavior, encouraging companies to invest more in research and development or pay dividends instead. He argued that higher taxes on buybacks would push companies towards distributing dividends, which could stimulate the economy by providing tax-free income to families earning below a certain threshold. This approach, he believes, could lead to a healthier economic environment by incentivizing companies to reinvest in their workforce and operations.

The discussion also delved into the state of manufacturing in the U.S., with Cuban noting that the post-pandemic manufacturing boom has not sustained itself. He pointed out that many manufacturing companies are small, with fewer than 20 employees, and criticized the heavy-handed approach of tariffs as a means to protect American industries. Instead, he advocated for incentives that would encourage manufacturing growth without resorting to punitive measures that could harm businesses.

Lastly, the conversation touched on broader economic issues, including inflation and immigration. Cuban expressed skepticism about claims of price gouging contributing to inflation, attributing it instead to excessive stimulus amid supply constraints. He also highlighted the challenges posed by immigration policies, arguing that an open border could negatively impact job growth for natural-born citizens. Overall, Cuban’s insights reflect a blend of economic strategy and national security considerations, underscoring the interconnectedness of these issues in shaping the future of the U.S. economy and its global standing.