The video highlights China’s intensified efforts to develop its domestic AI chip industry amid U.S. export restrictions, with companies like Cabochon, Wall, and Camera Icon advancing chip design despite technological and manufacturing gaps compared to American firms like TSMC. While China’s manufacturing capabilities lag behind in scale and yield, the government is committed to investing heavily to achieve self-sufficiency and long-term competitiveness in AI chip production.

The video discusses China’s efforts to bolster its domestic AI chip manufacturing industry, highlighting companies like Cabochon, which relies on SMIC, China’s equivalent of TSMC, for chip production. The discussion emphasizes the technological gap between American chipmakers and Chinese manufacturers like SMIC, particularly in terms of scale and production capabilities. This gap is a central concern for industry leaders such as Jensen Huang, especially following U.S. export restrictions on NVIDIA chips to China.

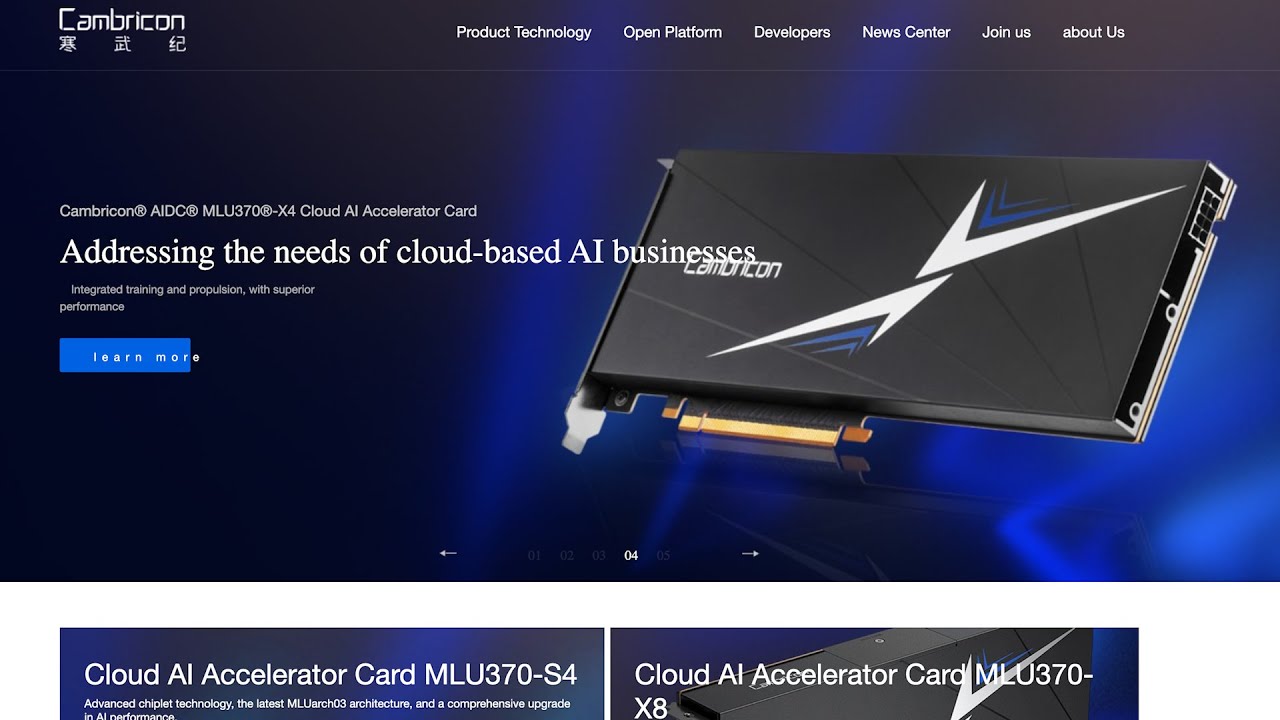

The Biden administration’s decision to cut off NVIDIA chip shipments to China has acted as a catalyst for the Chinese government and companies to aggressively invest in their own chip production technologies and AI chip design. Companies like Wall are gaining momentum in building AI chips and have been deployed in various applications. Another player, Camera Icon, is emerging as a smaller competitor, akin to AMD in the market, with plans to significantly increase AI chip production in the coming year, positioning themselves as a notable second supplier after Wall.

U.S. export controls have inadvertently opened opportunities for domestic Chinese production. Beijing is encouraging companies to prioritize domestic chips and has rejected the idea of importing certain foreign chips, such as those from H20, deeming them inadequate for the market’s needs. This reflects a strategic decision by China to develop self-sufficiency in AI chip manufacturing, signaling a long-term commitment to overcoming current technological and production challenges.

Despite progress in chip design, China’s manufacturing capabilities remain behind global standards. SMIC is currently producing chips at the seven-nanometer scale, lagging behind TSMC’s advanced three-nanometer technology. Additionally, SMIC faces significant yield issues, with only about 20% of produced chips being usable, compared to TSMC’s 80-90% yield rates. This disparity results in much higher production costs for Chinese manufacturers, highlighting the economic challenges they face in catching up.

Nevertheless, Beijing appears willing to absorb these higher costs as part of a strategic imperative to advance its domestic AI chip industry. The willingness to accept lower yields and higher expenses underscores the importance China places on achieving technological independence in this critical sector. The video concludes that while China is making notable progress in AI chip design and production, significant hurdles remain before it can compete on equal footing with leading global manufacturers.