The video discusses the recent decline in stock prices for major AI companies, despite a surge in demand for their products, and highlights a shift in investor focus from hardware and infrastructure to AI-native applications. It emphasizes the emergence of innovative startups like Cursor, which are rapidly proving their revenue potential, indicating a changing perception of value in the AI trade.

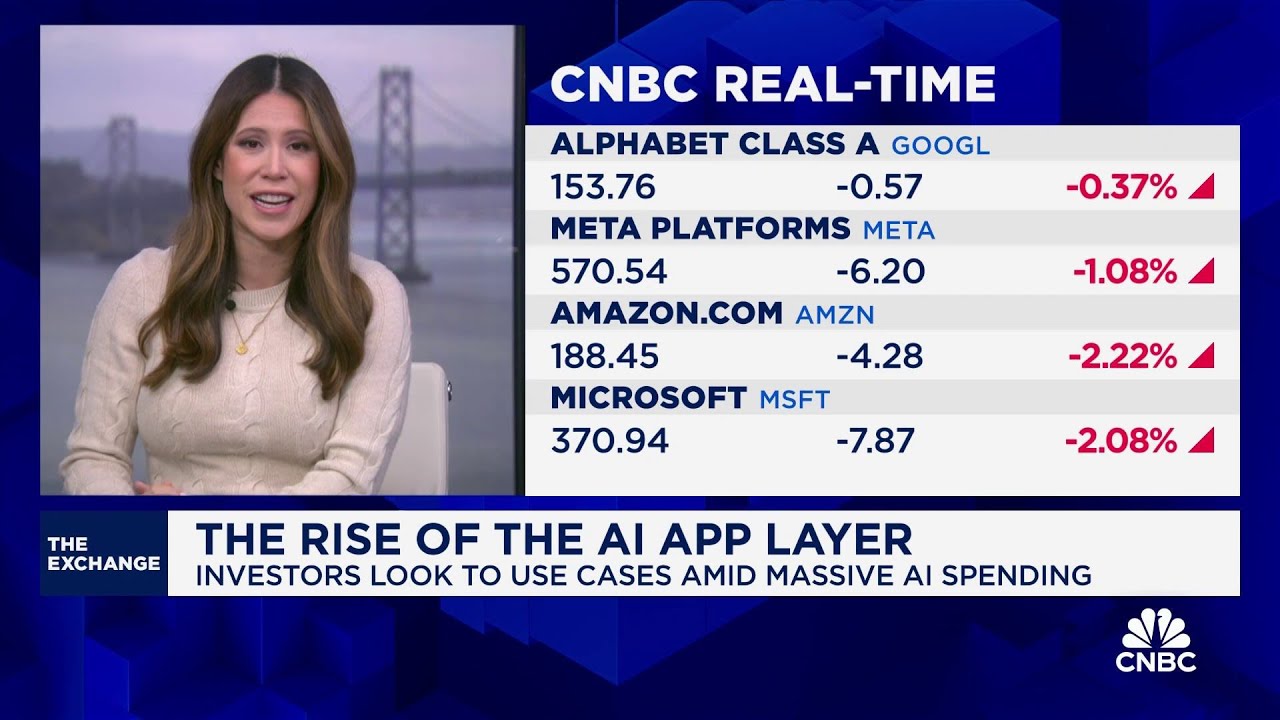

The video discusses the current state of the AI trade, highlighting a recent decline in stock prices for major companies like Nvidia, which fell nearly 4%. Despite this downturn, three prominent AI companies reported a surge in demand for their products over the weekend. The conversation shifts to the performance of ChatGPT, which has been experiencing glitches and slow response times, attributed to high demand by its CEO, Sam Altman. However, investors seem to be selling off AI-related stocks, indicating a potential shift in value from hardware and infrastructure to application layers in the AI sector.

Deirdre Bosa, the presenter, references a roadmap from Morgan Stanley that illustrates how the market typically recognizes semiconductor and infrastructure companies first during technological shifts. In the mobile era, for instance, the lasting value accrued to platforms like Google and Amazon, which sat atop the infrastructure. This pattern may be repeating itself in the current AI landscape, as investors remain skeptical despite claims of high demand for GPUs from industry leaders.

The video highlights the emergence of AI-native applications, such as Cursor, a coding startup that has reportedly surpassed $200 million in annual recurring revenue (ARR), making it one of the fastest-growing startups in the AI space. Unlike established tech giants like Microsoft and Google, Cursor is built entirely around AI, showcasing a clear contrast with public companies that are under pressure due to concerns about infrastructure spending outpacing actual demand and monetization.

The discussion also touches on the changing perception of AI applications, which were initially viewed with skepticism but are now gaining traction, especially in the venture capital world. The video emphasizes the importance of these AI-native apps, which are proving their revenue potential and use cases, as they adapt more quickly than legacy companies that struggle to pivot in the rapidly evolving tech landscape.

Finally, the video suggests that the rise of these AI applications, often referred to as “AI rappers,” is indicative of a broader trend where the focus is shifting from foundational AI models to the applications built on top of them. This shift could signal a significant change in how value is perceived in the AI trade, with investors increasingly looking towards innovative startups that are agile and focused on monetization rather than traditional infrastructure providers.