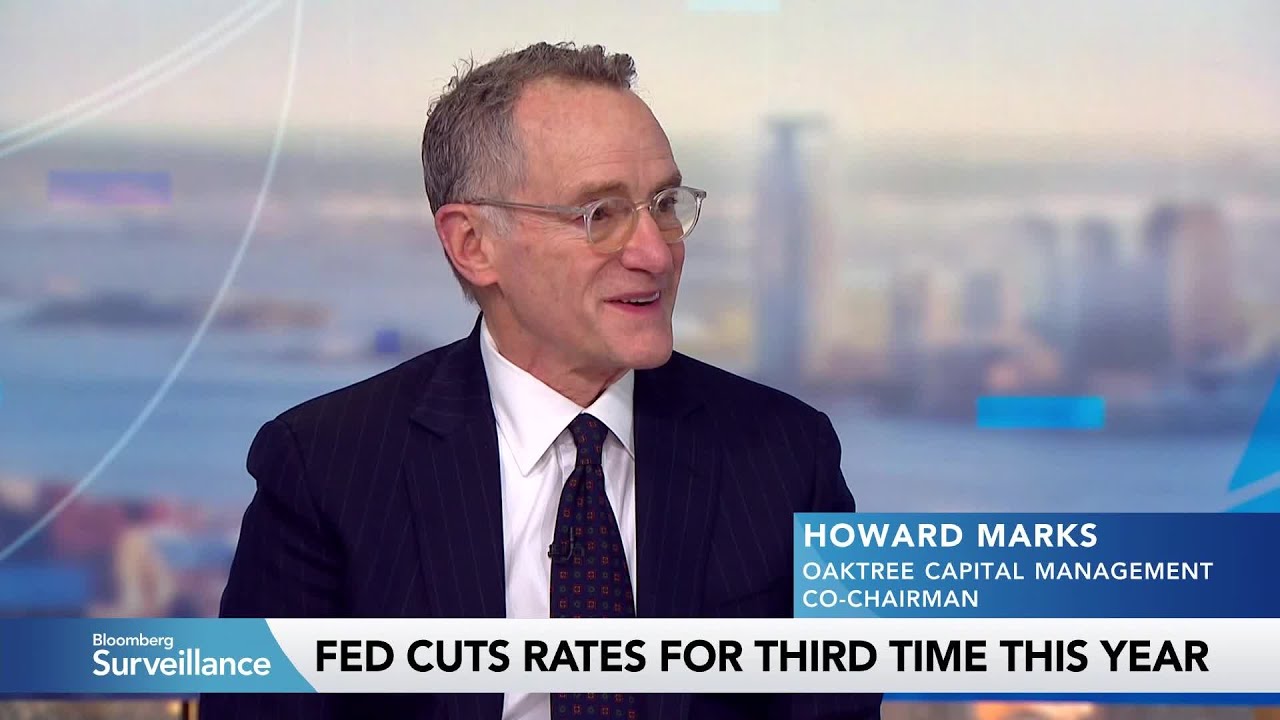

Howard Marks distinguishes AI as a transformative technological bubble with significant societal impact but warns of excessive financing and accelerated implementation, advocating cautious investment strategies favoring equity over debt in uncertain ventures. He also expresses concern about AI-driven job displacement’s broader social consequences, emphasizing that work provides essential purpose and structure beyond income, posing challenges for society amid evolving economic landscapes.

In the discussion, Howard Marks distinguishes between two types of bubbles in financial markets: unproductive bubbles, which he terms financial fads like portfolio insurance and subprime mortgages, and bubbles driven by technological progress such as the steam engine, railroads, and the internet. While the former tend to be overhyped and ultimately destructive without lasting benefits, the latter, despite their excesses and capital destruction, lead to irreversible societal advancements. Marks believes that artificial intelligence (AI) falls into the latter category, with significant societal impact, but cautions that its implementation might be excessively financed and accelerated.

Marks emphasizes the importance of caution when investing in such technologies. He advises that lending should only be done when there is clear visibility on the likelihood of repayment. For ventures with highly uncertain outcomes, equity investment is preferable over debt, as equity holders can benefit from potential upside, whereas lenders face limited returns and significant downside risk. This approach reflects a careful balance between risk and reward, especially in emerging and speculative sectors like AI.

Regarding market sentiment, Marks notes that when investors are overly enthusiastic, assets may become overvalued, while widespread disinterest can lead to undervaluation and opportunities. He views recent market reactions, such as the sell-off following Oracle’s announcement of increased borrowing, as a healthy sign of market discipline. This contrasts with past periods like 2006, where imprudence and lack of concern signaled danger. Overall, he finds the current market environment healthier than the tech bubble of 2000.

Marks expresses concern about Federal Reserve policies that keep interest rates artificially low and expand the balance sheet, which can encourage excessive risk-taking by making safe investments less attractive. He advocates for a more passive Fed role, intervening only when the economy is seriously overheated or underperforming. While some argue for lower rates, Marks sees little justification for such moves at present. He also highlights that current interest rates, though higher than the past 15 years, remain low by historical standards, leading to moderate expected returns in debt markets and low prospective returns in equities based on current valuations.

Finally, Marks addresses the societal implications of AI and automation, expressing deep concern beyond just economic or investment perspectives. He notes that while previous technological shifts like the internet did not reduce overall employment, they often lowered job quality by replacing white-collar jobs with lower-paying blue-collar roles. He worries that AI-driven job displacement could exacerbate issues of purposelessness and social malaise, drawing parallels to the opioid epidemic linked to job losses from automation and offshoring. Marks underscores that work provides more than income—it offers purpose and structure, which are difficult to replace, posing a significant challenge for society moving forward.