Dan Ives discussed the current economic challenges in America, particularly affecting the tech sector, and predicted a potential decline in global tech spending, especially among the “Magnificent Seven” companies. He emphasized Apple’s resilience despite cash flow concerns and warned that prolonged tariffs could harm demand, while also suggesting that software and cybersecurity sectors may offer safer investment opportunities amid the volatility.

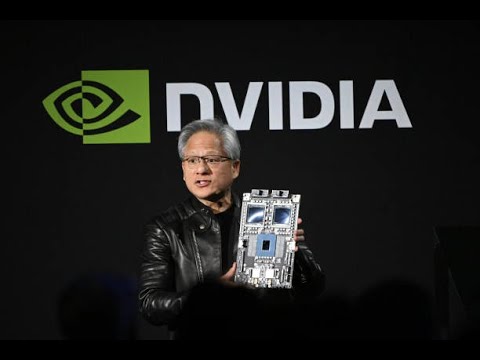

In a recent discussion, Dan Ives addressed the current economic crisis in America, highlighting the challenges faced by various sectors, particularly in technology and manufacturing. He noted that the recent downturn has led to a reassessment of price targets for companies, driven by extensive conversations with supply chain stakeholders and customers. Ives emphasized the importance of understanding the implications of these changes on financial forecasts, particularly in light of Nvidia’s recent markdown, which he viewed as a knee-jerk reaction to negative headlines.

Ives then shifted focus to the tech spending landscape, predicting a potential decline in global tech expenditures over the next year. He estimated that spending from the “Magnificent Seven” tech companies could see cuts of 10% or more, as investors begin to look towards 2026 for more normalized financial expectations. This uncertainty is compounded by the ongoing negotiations between the U.S. and China, which could significantly impact guidance and financial performance for tech firms.

The conversation also touched on Apple, with Ives reflecting on the company’s cash flow resilience despite the current crisis. He acknowledged that while there may be a slight decline in cash flow, Apple remains well-positioned due to its strong fundamentals and the leadership of CEO Tim Cook, who has a deep understanding of the supply chain dynamics in China. Ives warned, however, that any prolonged tariffs could lead to significant demand destruction for Apple products, particularly if costs rise dramatically.

Ives further discussed the broader implications of U.S. manufacturing efforts, particularly in light of recent challenges faced by companies like LVMH. He expressed skepticism about the feasibility of bringing manufacturing back to the U.S., citing labor force issues and the complexities of supply chains that are heavily reliant on Asian production. He emphasized that while the U.S. may currently lead in tech innovation, mismanagement of trade relations could allow China to regain an advantage.

Finally, Ives identified software and cybersecurity as safer investment areas within the tech sector, suggesting that companies in these fields could provide a defensive buffer against the current economic volatility. He reiterated that despite the challenges, investors should remain calm and avoid panic, as navigating the current landscape requires a strategic approach akin to high-stakes poker. Overall, Ives conveyed a cautious yet optimistic outlook for select tech stocks, including Apple and Nvidia, as they adapt to the evolving market conditions.