Rob Wertheimer from Melius Research highlights Caterpillar’s transformation from traditional heavy machinery to a key player in powering the AI era through its engines and turbines, leading to a bullish outlook with a $500 price target and reduced cyclicality. He also notes the broader industrial sector’s growth potential, including companies like United Rentals, driven by infrastructure expansion, reshoring trends, and increasing demand for AI-related energy solutions.

In the video, Rob Wertheimer from Melius Research discusses the bullish outlook on Caterpillar (Cat), highlighting its recent stock surge to the highest level since January and the firm’s upgrade of the stock to a buy with a $500 price target. Wertheimer emphasizes that Caterpillar is evolving beyond its traditional image as a maker of heavy machinery for earthmoving. Instead, the company is increasingly involved in powering the AI era, particularly through its engines and turbines that support energy demands in data centers and the strained power grid, creating new growth opportunities.

Wertheimer explains that Caterpillar has improved its management and expanded its aftermarket services, which has helped reduce the company’s historical cyclicality. Unlike previous cycles, the current environment lacks a mining upcycle in 15 years, suggesting that Caterpillar’s stock is less vulnerable to downturns and more poised for upside potential. This shift in the company’s business model and market dynamics makes it a more stable and attractive investment in the industrial sector.

The conversation also touches on the broader mining cycle and related companies like Komatsu and Cummins, which provide equipment and engines to the mining industry. Despite high commodity prices, mining companies have been cautious with capital expenditures, and the equipment cycle has yet to fully kick off. However, the demand for engines in data centers and other AI-related infrastructure is driving significant growth, indicating a shift in where industrial demand is coming from.

Regarding geopolitical factors, Wertheimer notes that while developing new mines, especially copper mines in the U.S., is a lengthy process due to environmental and regulatory hurdles, there is a growing trend toward reshoring and increased investment in North American mining. This trend is partly influenced by policies from recent U.S. administrations aimed at strengthening domestic supply chains and infrastructure, which could benefit companies like Caterpillar in the long term.

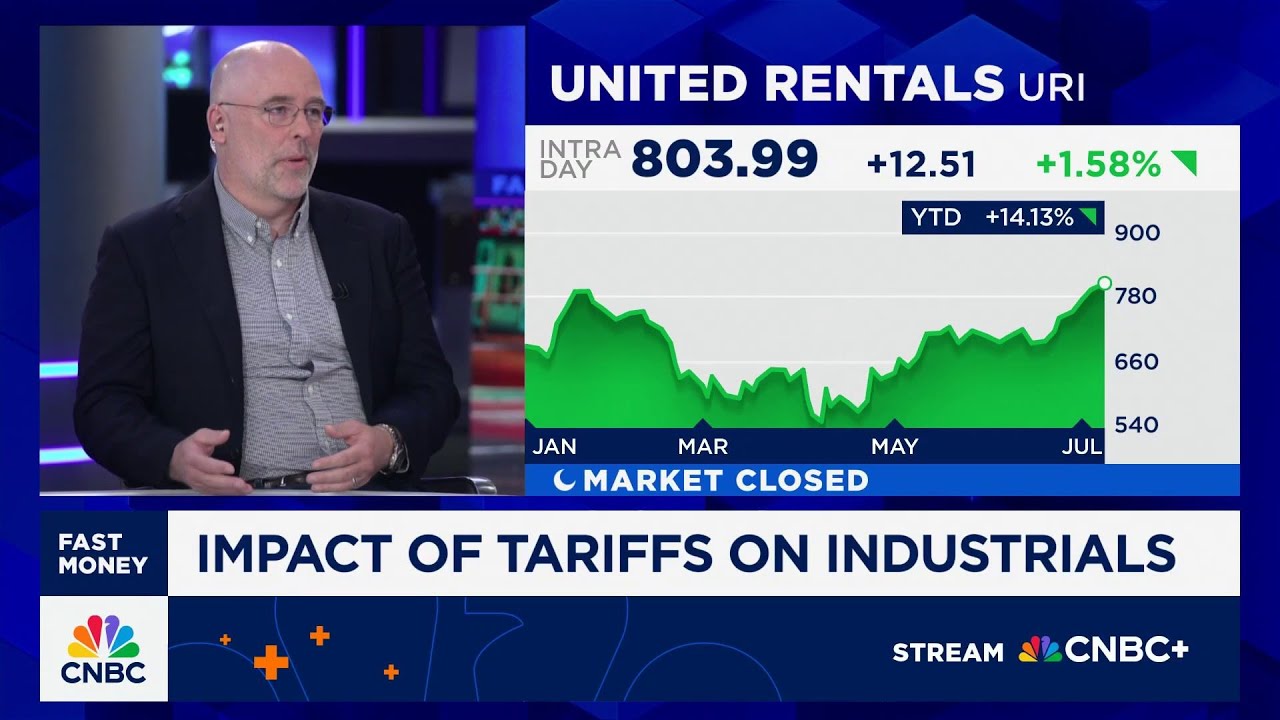

Finally, Wertheimer briefly discusses United Rentals, another company in the industrial equipment space, which Melius Research also rates highly. He describes United Rentals as a strong growth story in the U.S. construction equipment rental market, highlighting its consistent performance and leadership in a growing industry. This reinforces the broader positive outlook on industrials driven by infrastructure growth and evolving energy demands linked to the AI era.