The video highlights how Meta and Microsoft are boosting investor confidence in AI through increased adoption and CapEx commitments, but underlying issues like slowing spending growth, rising infrastructure costs, and intense competition raise concerns about the sustainability of these investments. It also emphasizes macroeconomic, regulatory risks, and the uncertain long-term profitability of the current AI investment surge.

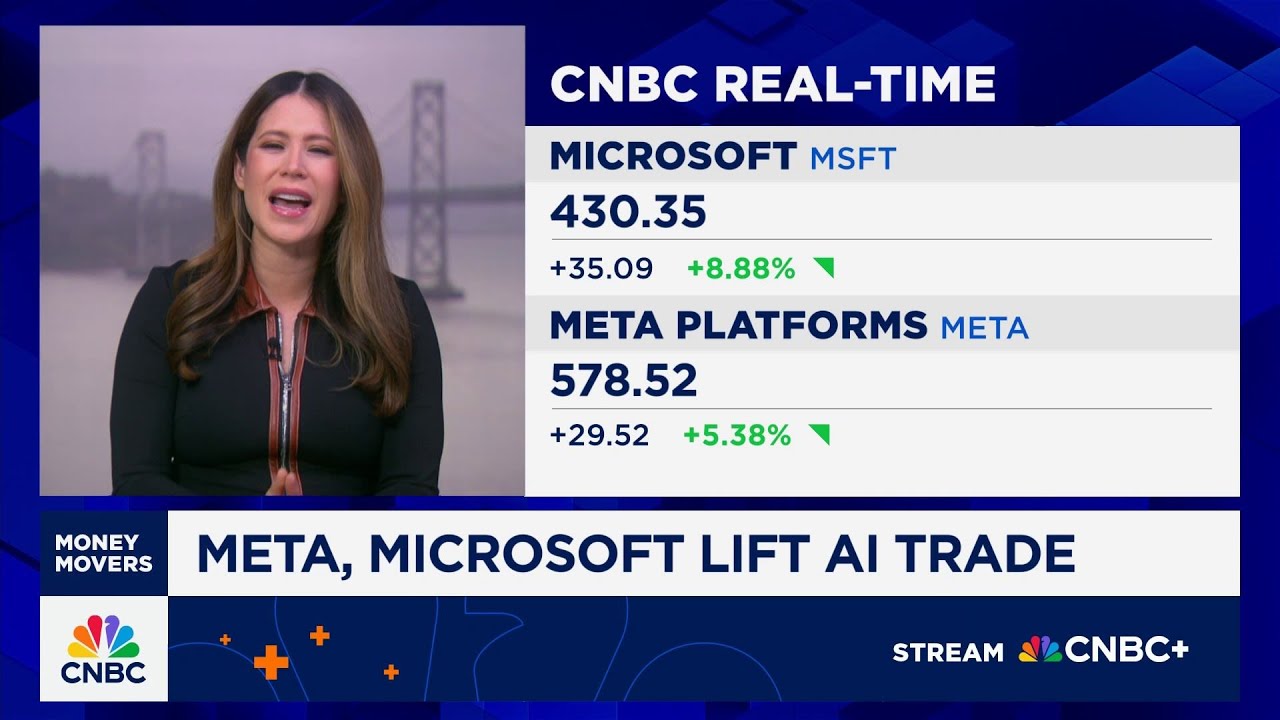

The video discusses recent developments in the AI sector, highlighting how major tech companies like Meta and Microsoft are influencing investor sentiment. Microsoft reaffirmed its commitment to capital expenditure (CapEx), while Meta reported a fourfold increase in GitHub Copilot users and saw growing adoption of its AI-powered advertising tools. These updates initially eased concerns about demand and monetization in the AI space, suggesting a positive outlook for AI investments. However, the overall picture remains complex, with underlying issues and uncertainties still present.

Despite these positive signals, some red flags remain. Microsoft’s latest quarterly report revealed its first quarter-over-quarter decline in CapEx in years, which could indicate a slowdown or recalibration in its AI buildout. Meta, on the other hand, plans to increase its CapEx by up to $7 billion, but this comes with caveats. Goldman Sachs warns that depreciation expenses are expected to spike significantly by 2026, and Meta’s infrastructure costs are likely to rise due to supply chain uncertainties and potential tariffs. These factors suggest that aggressive spending may not be sustainable or without risks.

The scale of Meta’s spending is particularly notable when compared to other hyperscalers like Microsoft, Google, and Amazon, which have large cloud businesses driving their AI investments. Meta’s focus is largely on its open-source Llama AI models, which are underperforming benchmarks and facing stiff competition from Chinese models such as Deep Seek, Alibaba’s Quen, and Xiaomi’s offerings. This raises questions about the efficiency and strategic value of Meta’s heavy investment, especially given the competitive landscape and the performance of its AI models.

Shareholder returns are also impacted by Meta’s high spending. The company’s quarterly share buybacks declined by 11% year-over-year, and no buybacks were conducted in the last quarter. This suggests that Meta is prioritizing capital expenditure over returning value to shareholders in the near term. The broader question remains whether the current AI investment frenzy will translate into sustained growth and profitability, or if it’s a temporary surge driven by hype and competitive pressures.

Finally, the video touches on macroeconomic and regulatory risks that could impact the AI sector. These include potential restrictions on GPU exports, legal challenges, and increased scrutiny from regulators worldwide. The recent Deep Seek selloff exemplifies how market sentiment can shift rapidly in response to geopolitical and regulatory developments. Overall, while some positive earnings reports and company updates provide optimism, significant uncertainties and competitive challenges continue to cast a shadow over the long-term prospects of AI investments.