Micron CEO Sanjay Mehrotra highlighted the company’s impressive 62% revenue growth in the fourth quarter, largely driven by the rising demand for AI-related products, particularly in the data center segment. He expressed optimism for 2025, predicting record revenues and improved profitability as Micron focuses on high bandwidth memory and other advanced technologies to meet the increasing memory needs of AI-enabled devices.

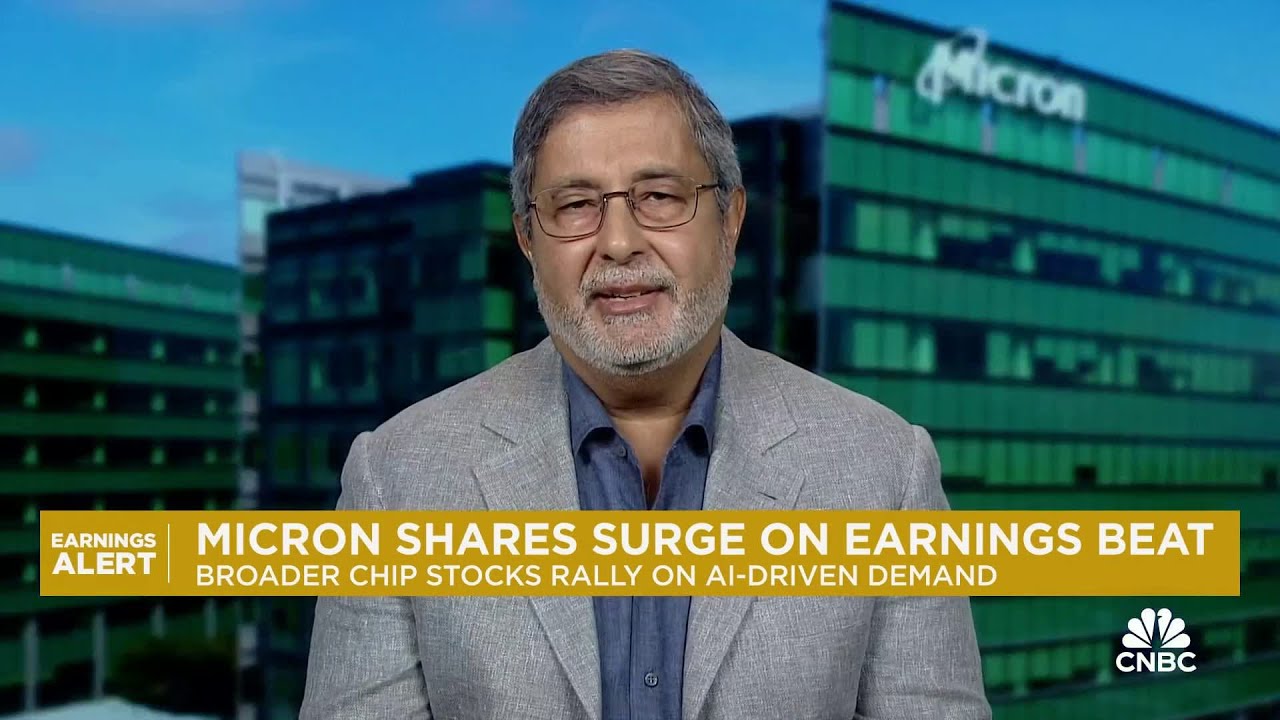

In a recent interview, Micron CEO Sanjay Mehrotra discussed the company’s strong performance in the fourth quarter and the transformative impact of artificial intelligence (AI) on the memory chip industry. He highlighted that Micron experienced a remarkable 62% growth in revenue for the fiscal year, attributing much of this success to the increasing demand for AI-related products. The company achieved record revenue in its data center segment, which is expected to continue growing in 2025, driven by various product lines that cater to AI needs.

Mehrotra emphasized the significant revenue generated from high bandwidth memory, which amounted to $700 million in fiscal 2024 and is projected to reach multiple billions in 2025. Additionally, he noted the strong performance of high-capacity DRAM and data center SSDs, with the latter hitting a record $1 billion in revenue in the fourth quarter alone. This growth is not limited to data centers; the demand for AI-enabled smartphones and PCs is also expected to increase memory content requirements, further driving revenue.

Addressing concerns about potential downturns in the smartphone and PC markets, Mehrotra explained that inventory buildups were a strategic response to anticipated tight supply conditions. He identified three main factors contributing to this inventory increase: the expectation of tight supply, the need for more memory in AI-enabled devices, and the opportunity to take advantage of lower memory prices. He expressed optimism that by 2025, inventory levels would stabilize, allowing for a resurgence in demand for AI-enabled devices.

As Micron shifts its focus and capital expenditures toward more profitable segments, Mehrotra discussed the growing importance of the data center business, particularly in AI applications. He noted that AI servers require more memory for both training and high-end inference tasks, positioning the data center segment as a key growth driver. The company anticipates a favorable supply-demand environment in 2025, which should enhance financial performance and profitability.

In conclusion, Mehrotra expressed confidence that 2025 would be a record revenue year for Micron, with significant improvements in profitability. He highlighted the company’s strategic focus on high bandwidth memory and other advanced products, which are expected to contribute positively to gross margins. Overall, the interview underscored Micron’s commitment to leveraging AI trends to drive growth and innovation in the memory chip market.