Eli, the computer guy, exposes Microsoft’s lack of transparency in disclosing substantial financial losses related to its investment in OpenAI, highlighting inflated AI company valuations and questionable accounting practices that obscure the true economic impact. He warns that this widespread obfuscation, tolerated by regulators amid the AI boom, risks delaying a significant financial reckoning and calls for greater scrutiny and practical tech education.

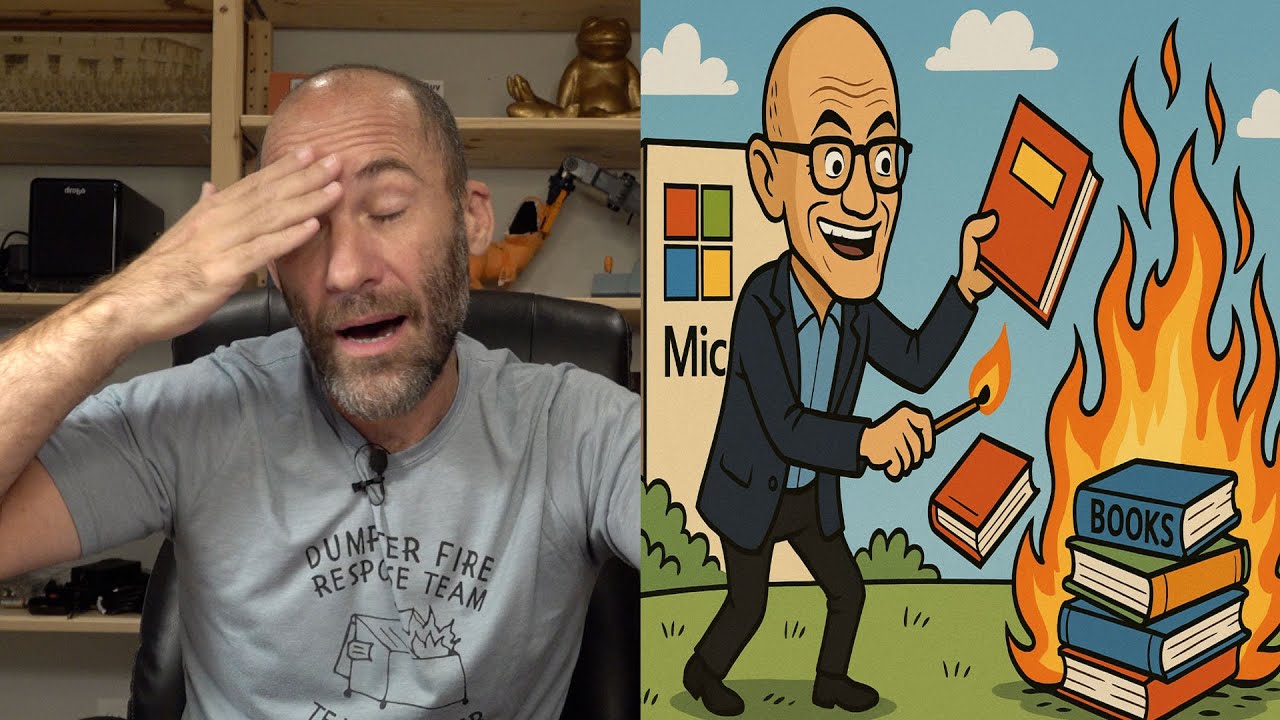

In this video, Eli, the computer guy, discusses concerns about Microsoft’s financial transparency regarding its investment in OpenAI. He highlights a Wall Street Journal report revealing that Microsoft has not fully met its financial disclosure requirements related to OpenAI, despite being a publicly traded company subject to SEC regulations. Microsoft vaguely disclosed a $4.7 billion loss linked to OpenAI in a less prominent section of its financial filings, avoiding clear communication in earnings calls and press releases. This lack of transparency raises questions about how much investors truly understand the financial impact of Microsoft’s OpenAI dealings.

Eli points out that the valuations of AI companies like OpenAI, Anthropic, and XAI have skyrocketed to hundreds of billions of dollars, which he argues do not make financial sense given the current technology and market realities. He criticizes the massive capital expenditures planned by these companies, such as OpenAI’s proposed $4 trillion investment in data centers, as unrealistic and unsustainable. Despite the groundbreaking nature of AI technology, Eli believes the hype and valuations are inflated, and the financial losses reported by OpenAI, even on high-priced subscription plans, indicate a business model that is not yet profitable.

The video also delves into the accounting practices Microsoft uses to obscure the true financial picture. Microsoft categorizes its OpenAI-related losses under a vague “other” line item, making it difficult for investors to assess the real impact. The company owns 27% of OpenAI, a stake valued at around $100 billion based on OpenAI’s $500 billion valuation, which is nearly equivalent to a full year of Microsoft’s earnings. Despite this material investment, Microsoft has not disclosed key details such as the fair market value of its stake, the carrying amount of the investment, or the nature of revenue-sharing agreements with OpenAI, raising concerns about compliance with SEC disclosure rules.

Eli argues that this obfuscation is part of a broader trend where big tech companies and regulators like the SEC are turning a blind eye to financial irregularities in the AI sector. He suggests that the government may tolerate these practices because the AI boom is currently boosting U.S. GDP growth, which is politically favorable. However, he warns that this lack of transparency and regulatory oversight only delays and worsens the inevitable financial reckoning. Eli also emphasizes the growing importance of financial and legal expertise in the tech industry, as much of the innovation and value extraction now occurs in these domains rather than purely in technology development.

In conclusion, Eli calls the current AI investment frenzy a “legal fraud” where companies inflate valuations and obscure losses to maintain investor confidence. He urges viewers to critically assess the financial realities behind the AI hype and to consider the long-term implications of these practices on the economy and society. He invites comments and discussion from his audience and promotes his hands-on technology education classes in Durham, North Carolina, encouraging people to engage with practical tech skills amid the ongoing AI boom.