Nvidia’s recent stock surge is driven by its transformation into a leading AI infrastructure company, leveraging advanced technologies like NVLink and InfiniBand to support large-scale AI workloads and cloud computing. Additionally, growth opportunities in autonomous vehicles and strategic moves to bypass traditional cloud providers position Nvidia for continued expansion beyond traditional chip manufacturing.

Nvidia has recently experienced a significant surge in its stock price, jumping over 40% since April and briefly reaching a $4 trillion market capitalization. This impressive growth is driven not just by traditional chip sales but by the company’s transformation into a leading AI infrastructure powerhouse. CEO Jensen Huang has emphasized that Nvidia is evolving beyond being merely a GPU manufacturer, now positioning itself as an AI algorithm firm with chip design playing a secondary role. This strategic shift has resonated strongly with investors, fueling optimism about the company’s future.

Several factors have contributed to Nvidia’s recent rally. Besides the pivot to AI infrastructure, easing US-China trade tensions and multi-billion dollar chip deals in the Middle East have provided additional momentum. However, the core of Nvidia’s long-term growth thesis lies in its comprehensive full-stack strategy, particularly in networking technologies. Bank of America highlights Nvidia’s NVLink technology as being one to two generations ahead of competitors, enabling faster communication between chips, which is crucial for handling large-scale AI workloads.

Another key technology is Nvidia’s InfiniBand, which facilitates ultra-high-speed communication across servers and data centers. This capability is essential for cloud computing environments that support AI applications. Nvidia is also expanding its reach through the DGX Cloud Lepton platform, which allows direct access to developers via partners like CoreWeave and Lambda. This approach helps Nvidia bypass traditional cloud providers such as AWS, who are increasingly developing their own chips to reduce reliance on Nvidia’s hardware.

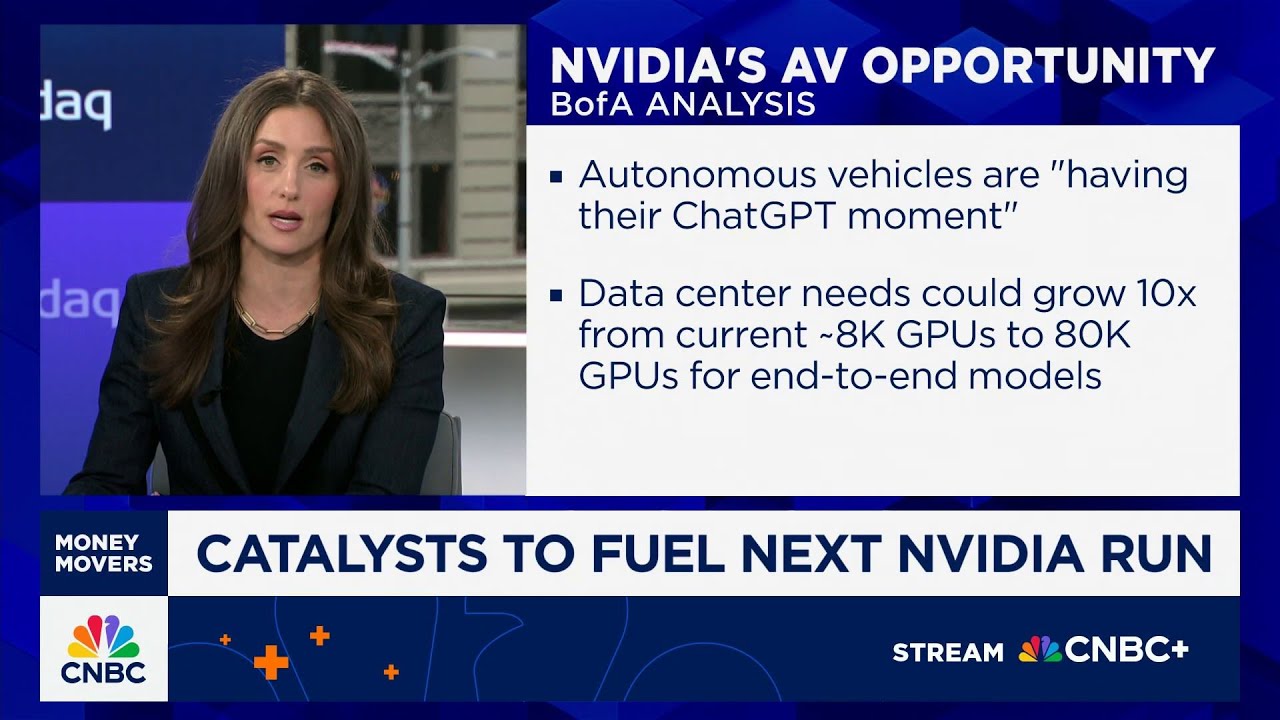

In the autonomous vehicle sector, Nvidia sees significant growth potential. Although currently contributing only about 1% of Nvidia’s fiscal 2025 sales, the demand for GPUs in autonomous driving systems is expected to skyrocket. Bank of America notes that the industry is experiencing a “ChatGPT moment,” with massive data requirements driving GPU usage from 8,000 to potentially 80,000 GPUs in the near future. This surge in GPU demand for autonomous vehicles represents a substantial opportunity for Nvidia to expand its market share.

Overall, Nvidia’s expanding presence across AI networking, cloud computing, and autonomous vehicle technology illustrates why Wall Street values the company far beyond a traditional chipmaker. Its innovative technologies and strategic partnerships position Nvidia as a critical player in the AI infrastructure ecosystem, setting the stage for continued growth and potentially fueling the next leg higher in its stock price.