Eli, the computer guy, explains that Nvidia’s $5 billion investment in Intel is a strategic move to preserve the U.S. technology ecosystem amid Intel’s decline and rising geopolitical tensions with China, highlighting Intel’s struggles and the risks of a fragmented tech stack. He remains skeptical about Intel’s future without visionary leadership, viewing the investment as a desperate attempt to keep the company afloat rather than a guaranteed path to innovation or competitiveness.

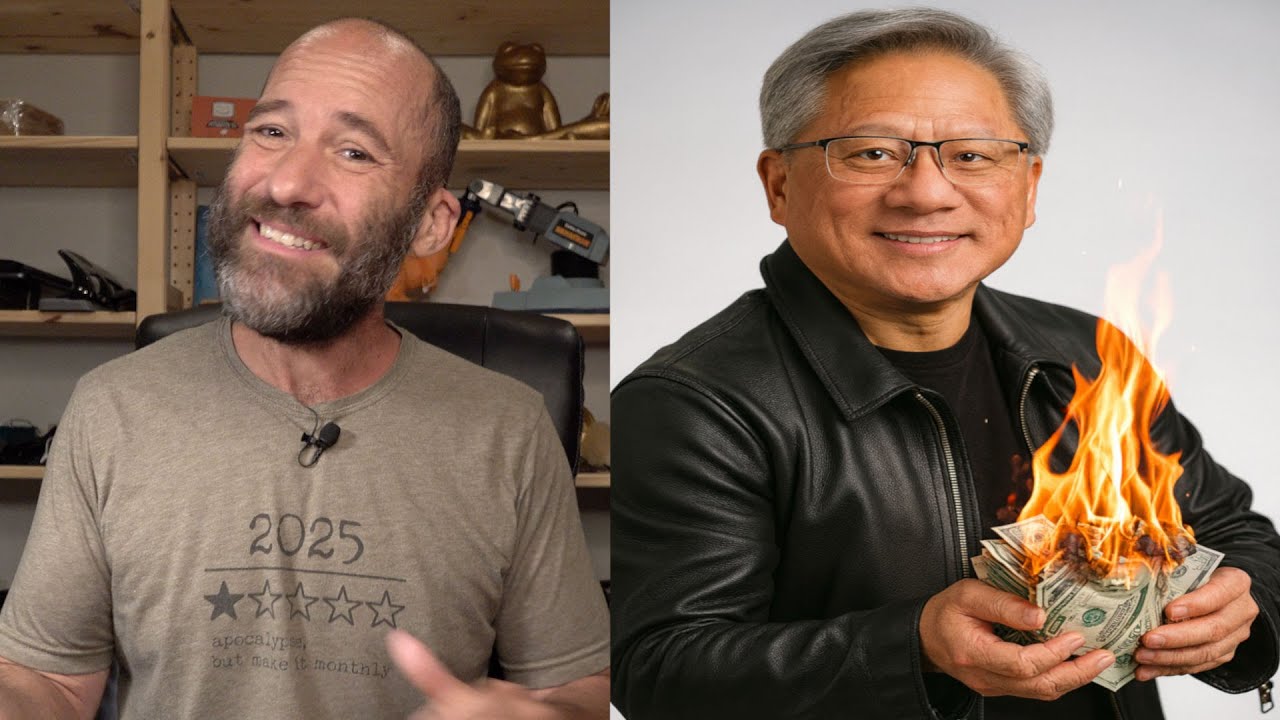

In this video, Eli, the computer guy, discusses Nvidia’s recent $5 billion investment in Intel, framing it as a desperate attempt to save the U.S. technology stack amid increasing geopolitical tensions with China. He explains that while Nvidia is a $4 trillion company and Intel is valued at around $150 billion, Nvidia’s investment is less about Intel’s current success and more about the necessity of Intel’s survival for the broader tech ecosystem. Eli emphasizes that modern technology products rely on complex stacks of components from multiple companies, and if a key player like Intel fails, it could jeopardize the entire system’s functionality.

Eli highlights Intel’s ongoing struggles, describing the company as being in a “death spiral” due to poor strategic decisions, massive layoffs, and failures in key markets like 5G and competing with ARM processors. He contrasts this with China’s approach, where companies like Huawei are building integrated AI systems rather than relying on fragmented components from multiple vendors. This integrated approach gives China an advantage in the AI arms race, while the U.S. tech stack risks fragmentation and failure if companies like Intel falter.

The video also touches on the political dimensions of the investment. The U.S. government recently bought a 10% stake in Intel, and Japan’s SoftBank invested $2 billion, signaling a coordinated effort to prop up Intel as a strategic asset. Eli suggests that Nvidia’s investment might also be a political move to curry favor with the U.S. government and potentially ease restrictions on selling AI hardware to China. He points out that Nvidia’s AI hardware sales to China have been severely limited, and this partnership with Intel could be part of a broader strategy to navigate these geopolitical challenges.

Eli reflects on Intel’s lack of a clear, exciting vision for the future, contrasting it with past innovative projects like Edison (a system-on-chip platform), Jarvis (a verbal augmented reality system), and Real Vision (a computer vision system), which have since faded away or been sold off. He criticizes Intel’s current leadership and culture for failing to build on these innovations or present a compelling roadmap, making it unclear how the recent influx of capital will translate into meaningful progress or competitive products.

In conclusion, Eli views Nvidia’s $5 billion investment in Intel as a last-ditch effort to keep Intel afloat, hoping for a transformative leader akin to Steve Jobs to revive the company. However, he remains skeptical about Intel’s prospects and the effectiveness of simply throwing money at the problem without a strong vision or execution plan. He invites viewers to share their thoughts on the situation and promotes his educational platform, Silicon Dojo, where he plans to offer classes on AI and related technologies.