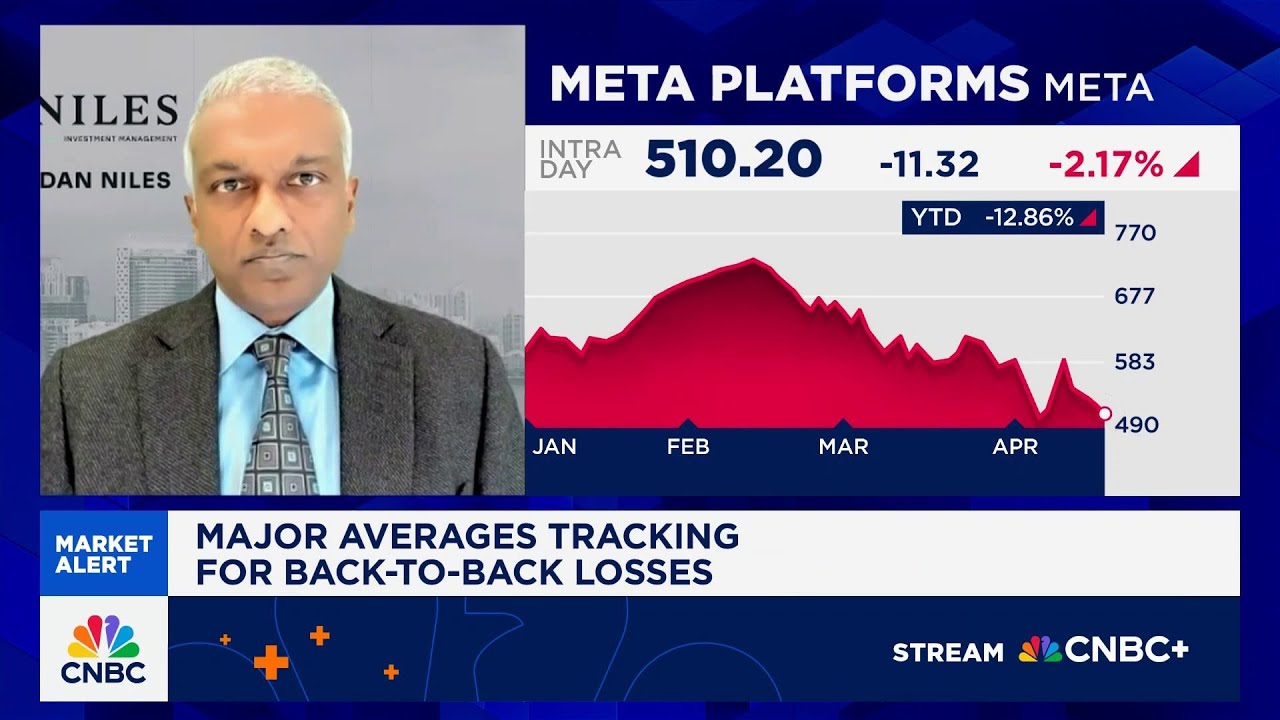

Dan Niles of Niles Investment Management discussed Nvidia’s $5.5 billion writedown, expressing skepticism about the company’s growth expectations in the AI sector and highlighting a potential slowdown in capital expenditures. He warned that the market may be entering a “digestion phase,” where initial excitement is recalibrated, urging investors to reassess their expectations and adopt a cautious approach.

In a recent discussion, Dan Niles, founder and portfolio manager at Niles Investment Management, shared his insights on Nvidia’s significant $5.5 billion writedown and its implications for the AI sector. He noted that Nvidia’s stock dropped 7% following the news, and while some analysts attempted to frame the situation positively by suggesting it de-risks China, Niles expressed skepticism. He likened the situation to trying to sell a high-performance car that can only reach a fraction of its potential speed, questioning the rationale behind the writedown given the purported high demand for Nvidia’s products.

Niles pointed out that the market had been operating under the assumption that Nvidia’s revenues would continue to grow sequentially by 10-11% each quarter. However, he highlighted a mismatch between this expectation and the actual guidance provided by Nvidia’s customers, which indicated a slowdown in capital expenditures related to AI. He emphasized that the demand for chips was being artificially inflated due to companies rushing to purchase ahead of potential export tariffs and sanctions, suggesting that a correction in expectations was imminent.

The conversation then shifted to the broader market, particularly the “MAG seven” tech stocks, which include major players like Microsoft, Amazon, and Google. Niles noted that many of these companies had already seen their revenue estimates cut prior to the recent market pullback. He explained that while there had been some short-term trading opportunities, the structural outlook for these companies remained concerning, as estimates were likely to continue declining.

Niles reflected on the historical context of market behavior, noting that during periods of Fed rate cuts, stock prices often rise regardless of underlying fundamentals. He cautioned that this could lead to a disconnect between stock performance and actual company performance, as seen in the past. He emphasized the importance of being cautious and not trying to predict the bottom of stock prices, as they often fall further than anticipated.

In conclusion, Niles reiterated his belief that the AI sector is entering a “digestion phase,” where the initial excitement and demand are being recalibrated. He suggested that the recent developments with Nvidia and the broader MAG seven stocks indicate a need for investors to reassess their expectations and be prepared for further adjustments in revenue forecasts. Overall, he advocated for a cautious approach in navigating the current market landscape.