Oracle’s stock surged 40% due to a robust $450 billion order backlog and a bullish outlook on its AI cloud services, supported by strategic investments in infrastructure and partnerships with chip manufacturers like Nvidia. Leveraging its high-margin software business to fund cloud expansion without heavy borrowing, Oracle is rapidly transforming into a major AI cloud player despite trailing behind giants like Amazon and Microsoft in cloud revenue.

The video discusses Oracle’s recent stock surge, driven primarily by its substantial order backlog valued at approximately $450 billion. This backlog is expected to translate into revenue over the coming years as Oracle activates its data centers and transitions workloads to the cloud. The market’s bullish reaction is tied to this strong order book and the company’s promising cloud outlook, which extends through the end of the decade.

Oracle is positioning itself in the competitive AI cloud space by renting out GPU capacity to customers for training and running AI models. Unlike other cloud providers, Oracle benefits from a high-margin software and applications business that helps fund its expansion in cloud infrastructure. This financial strength allows Oracle to grow its AI-related cloud services without relying heavily on borrowing, giving it a competitive edge over other “neo cloud” providers.

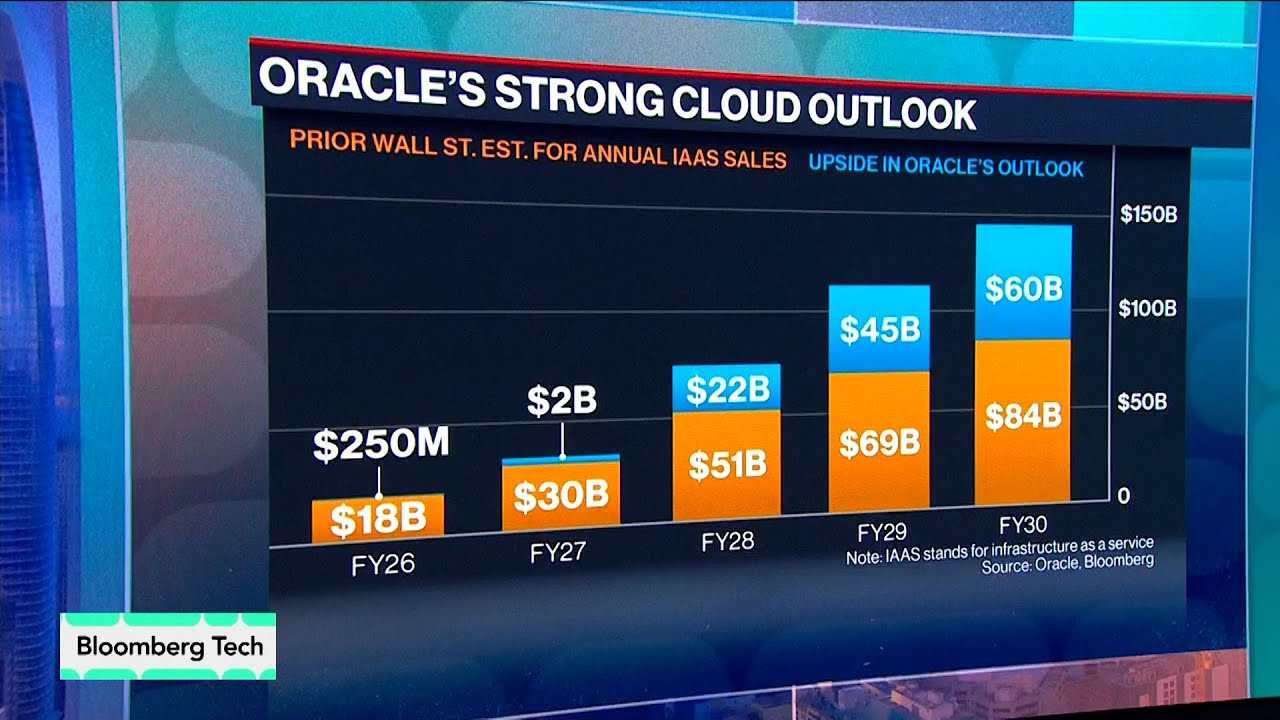

The video highlights a forecast showing a potential $60 billion upside for Oracle by the end of the decade, based on the company’s guidance compared to market consensus. This optimistic outlook is supported by Oracle’s recent investments in infrastructure, including partnerships with chip manufacturers like Nvidia, enabling it to offer scalable computing power for AI workloads. The demand for such computing capacity is currently very high due to a widespread shortage, benefiting major cloud providers including Oracle.

Oracle’s cloud infrastructure revenue, while growing, still trails behind giants like Amazon and Microsoft Azure, with Oracle generating around $10 billion annually compared to Amazon’s $125 billion and Azure’s $75 billion. Despite this, Oracle’s strategic pivot towards cloud and AI services has been underway for several years, initially focused on supporting its core database business but now expanding to broader cloud computing offerings.

Overall, the video portrays Oracle’s transformation from a traditional database software company to a significant player in the AI cloud market. This shift, described as a “hard pivot,” has been gradual but is now gaining momentum as Oracle leverages its existing strengths and infrastructure to capitalize on the booming demand for AI computing resources. The company’s strong order book, strategic investments, and unique financial position underpin the optimistic market sentiment reflected in its stock price jump.