JPMorgan’s Aliaga advises investors to remain engaged in the tech sector, highlighting that increased selectivity and debt issuance by major tech firms reflect healthy market dynamics rather than bubble risks. He emphasizes the growing importance of AI adoption and efficient capacity utilization, recommending diversified tech exposure to capitalize on future growth while avoiding premature market exits.

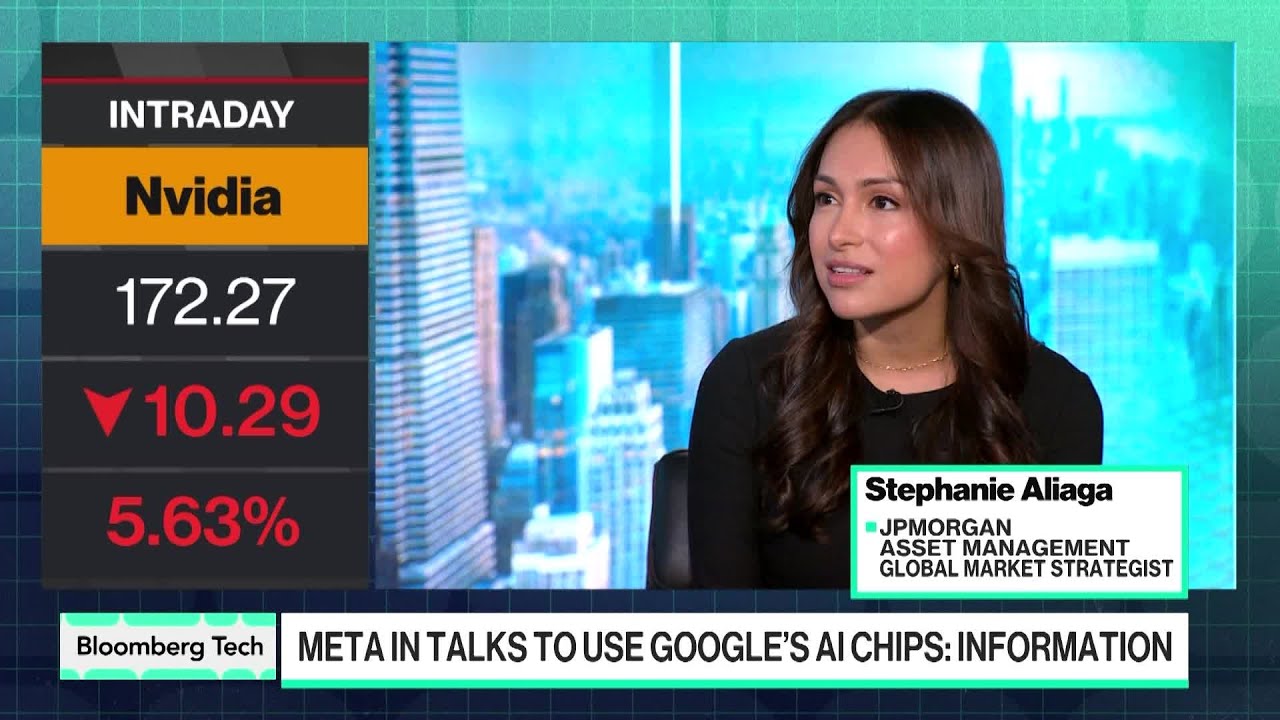

JPMorgan’s Aliaga views the current scrutiny and debate around the dominance of top US tech companies as a healthy development for the market. After two years of strong returns driven by the tech trade, investors are now more selective and discerning about investment quality and spending. This shift from a broad rising tide lifting all boats to choppier waters helps prevent the formation of a bubble similar to the dot-com era. Despite concerns, valuations among big tech firms do not currently indicate a significant bubble risk.

There has been a notable increase in these tech giants tapping into debt markets, with companies like Alphabet, Microsoft, and Oracle issuing bonds that have been well received. While some worry that frequent bond issuance by hyperscalers could crowd out other borrowers and drive up borrowing costs, Aliaga believes the scale of investment needed justifies this approach. He emphasizes that the capital structures are improving, with debt financing often making sense for long-term investments such as data centers, rather than signaling overextension.

Credit default swaps (CDS) activity, particularly for Oracle, is seen as a useful indicator of risk, reflecting the varying risk profiles among tech companies. However, this should not be generalized across the entire sector. Cloud services remain one of the most cash-generative business models globally, supporting the creditworthiness of these companies despite increased debt issuance. The discussion also touched on margin pressures in hardware suppliers like Dell and HP due to rising memory costs, while memory chipmakers like Micron are expected to benefit from strong demand.

Looking ahead, Aliaga believes the tech trade still has room to grow but with a shift in focus. The next phase will emphasize not just capacity expansion but also utilization efficiency and the critical role of companies leading AI adoption across various sectors, including finance and entertainment. The true catalyst for revaluating tech investments will be clearer proof of AI monetization, particularly as companies outside traditional tech sectors report AI-driven cost savings and revenue growth in their earnings.

Clients are advised to diversify their tech exposure rather than concentrate heavily in a few names, balancing the gains already achieved with positioning for the evolving AI wave. Aliaga cautions against exiting the market prematurely, noting that missing out on major growth periods can lead to long-term underperformance. While there is no systemic bubble risk in US equities currently, building resilient portfolios that can adapt to ongoing technological shifts is key to capitalizing on future opportunities.