The American airline industry is marked by intense competition and regulations that prevent any airline from dominating the market, leading to a struggle for low-cost carriers like Southwest and JetBlue to maintain their edge against legacy airlines such as Delta and United. Despite initial success, low-cost carriers now face financial difficulties as legacy airlines adapt their strategies, introduce tiered pricing, and capitalize on established market advantages, further complicating the competitive landscape post-COVID-19.

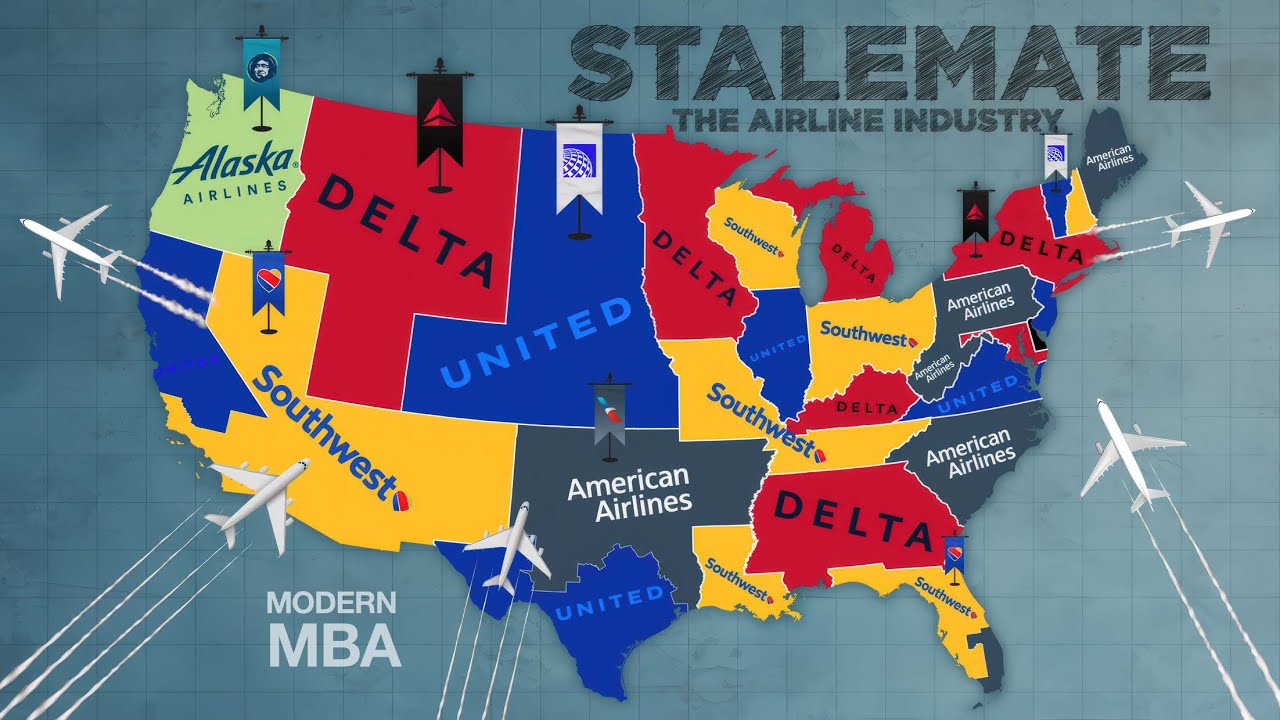

The American airline industry is characterized by intense competition and stringent regulations that prevent any single airline from capturing more than 18% market share. The Justice Department blocks mergers that would exceed this threshold, maintaining a fragmented market. Historically, low-cost carriers like Southwest and JetBlue emerged in the last decade as innovators, offering cheaper fares and better amenities compared to legacy airlines such as Delta and United. However, the landscape has shifted, with low-cost carriers now facing financial struggles while legacy carriers have regained their dominance in earnings and market valuations.

The airline industry operates on a capital-intensive model where the volume of flights and passengers is crucial for profitability. Airlines invest heavily in purchasing and maintaining fleets, which can cost hundreds of millions. The success of an airline relies on its ability to fill seats, a metric known as load factor, which has averaged between 70-80% across the industry. High operational costs, particularly fuel and labor, further constrain profit margins, making it challenging for airlines to remain financially viable despite increasing passenger numbers.

Legacy carriers have capitalized on their established hub-and-spoke model, which allows them to centralize operations and maximize profitability by funneling passengers through strategic hub airports. This model creates “fortresses” where one airline dominates, allowing them to raise prices without competition. As legacy carriers invested in international routes and premium services, they attracted business travelers, which fueled their profitability. Meanwhile, low-cost carriers thrived initially by tapping into price-sensitive customers but struggled to compete with the infrastructure and market presence of legacy airlines.

The emergence of basic economy fares by legacy carriers introduced a tiered pricing strategy, allowing them to compete directly with low-cost airlines without sacrificing their market advantages. This shift eroded the competitive edge that low-cost carriers had enjoyed, forcing them to lower their fares further to maintain market share. As a result, profit margins for low-cost airlines began to decline, and many faced the prospect of bankruptcy as they struggled to adapt to the changing market dynamics.

In the aftermath of the COVID-19 pandemic, legacy airlines demonstrated resilience while low-cost carriers continued to face challenges returning to profitability. The legacy carriers have adapted by offering flexibility in ticket changes and investing in loyalty programs, making them more appealing to travelers. As the competitive landscape has shifted, low-cost carriers like Spirit, Frontier, and JetBlue find themselves in an identity crisis, trying to balance their low-cost appeal with the need for a more reliable service that meets the demands of today’s travelers. The perception of an “rigged” industry persists, with first-mover advantages favoring legacy carriers in the ongoing battle for market share.