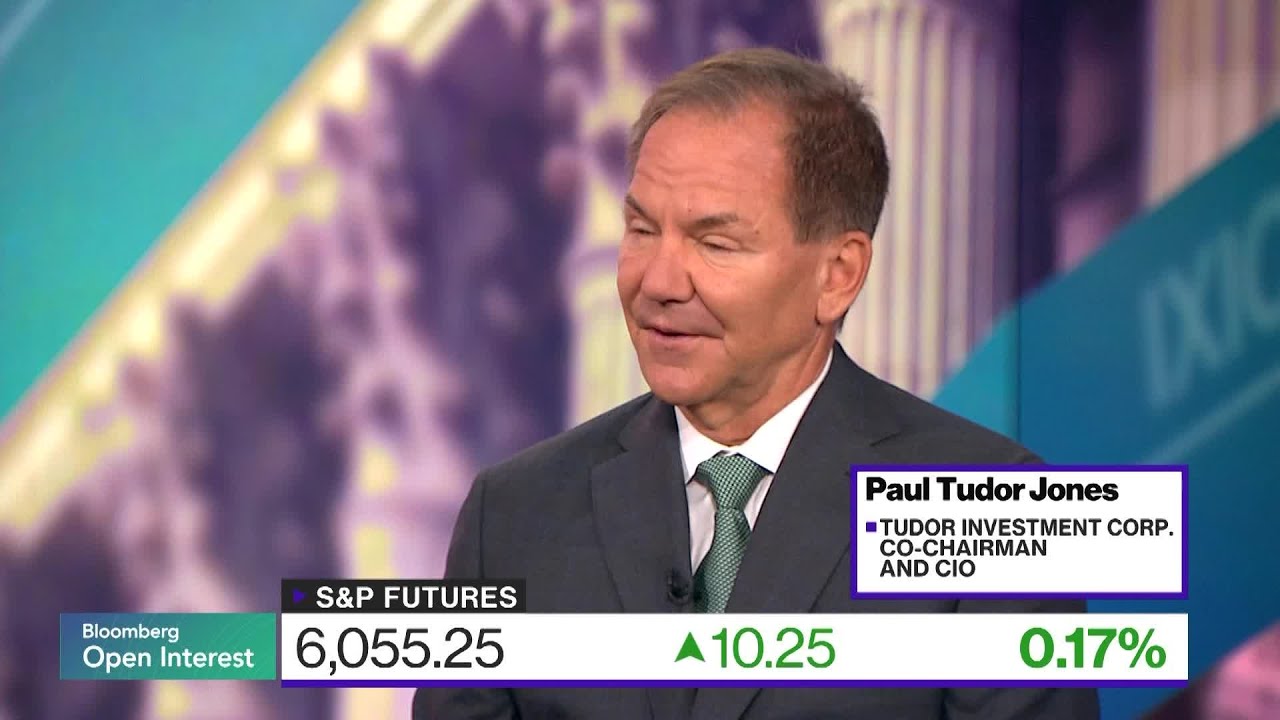

Tudor Jones discusses the outlook for U.S. interest rates, fiscal sustainability, and market strategies, emphasizing a potential decline in short-term rates, a weaker dollar, and the importance of assets like gold and Bitcoin as hedges. He also highlights the transformative and risky potential of artificial intelligence, advocating for regulation to ensure societal benefits and mitigate threats.

In the video, Tudor Jones discusses a recent investor competition held before their annual fall conference, which raised around $400,000, primarily benefiting Robinhood. The competition involved participants making long and short bets, with top performers like Bill Ackman and Stan Druckenmiller achieving extraordinary returns, suggesting that following their strategies could have yielded significant profits. Jones emphasizes the potential to expand this event and encourages more participation, especially among women, highlighting the importance of engaging a broader investor base.

Jones then delves into his outlook on the yield curve, predicting that short-term rates will decline sharply in the coming year due to anticipated dovish Federal Reserve policies, especially with a new Fed chair likely to be appointed within six months. He explains that a dovish stance, combined with fiscal constraints and high debt levels, will lead to lower interest rates, similar to Japan’s current approach. He emphasizes that running negative real rates is a strategy to manage high debt-to-GDP ratios, which could result in a steepening yield curve and a weaker dollar over the next year.

The conversation shifts to concerns about the U.S. fiscal deficit and the sustainability of current spending and tax policies. Jones outlines a hypothetical scenario where balancing the budget would require significant austerity measures, including substantial tax hikes and across-the-board spending cuts. He warns that eventually, bond markets will push back against excessive deficits, potentially leading to a reevaluation of government debt sustainability. Despite these challenges, he notes that other countries with worse fiscal positions, like Japan and some European nations, are managing, which complicates the long-term outlook for U.S. fiscal health.

Jones discusses investment strategies in this environment, favoring assets like gold, Bitcoin, and stocks, which can serve as hedges against inflation and fiscal instability. He predicts that the yield curve will steepen, the dollar will weaken, and equities may face headwinds if interest rates rise or if market confidence erodes. He also touches on the potential for significant long-term declines in stock multiples if markets fully price in the consequences of mounting debt and fiscal irresponsibility. Despite current optimism, he remains cautious about the sustainability of the current economic trajectory.

Finally, Jones addresses the transformative potential of artificial intelligence, expressing both optimism and concern. He highlights recent advances in quant modeling and AI’s ability to democratize sophisticated investment strategies, which could revolutionize markets. However, he warns about the risks associated with AI, including job displacement, safety issues, and the lack of regulation, especially given the rapid growth of these technologies. He advocates for thoughtful regulation and societal discussions on how to distribute the productivity gains from AI equitably, emphasizing that without safeguards, AI could pose significant threats to economic stability and social cohesion.