Major tech companies are projected to increase their capital expenditures on AI to $320 billion this year, but investor sentiment has shifted, leading to a pullback in tech stocks despite these investments. Concerns over tariffs, skepticism about the pace of AI development, and potential profit erosion are causing Wall Street to adopt a more cautious outlook on the immediate benefits of AI spending.

In the latest tech update, significant earnings and guidance from major tech companies like Meta, Amazon, Microsoft, and Alphabet indicate a projected $320 billion in capital expenditures for the year, marking a 40% increase from last year’s already high figures. Despite these massive investments in AI infrastructure, including chips, servers, and networking, investor sentiment appears to be shifting, leading to a notable pullback in tech stocks in early 2025.

Kristina Partsinevelos reports that while tech giants continue to invest heavily in AI, Wall Street’s reaction has changed dramatically compared to the previous year. In April 2024, stocks of AI-focused companies such as Nvidia and Broadcom surged following announcements of major investments. However, the same stocks have seen minimal movement recently, with an average gain of only 1% last week, indicating a stark contrast to the excitement of the previous year.

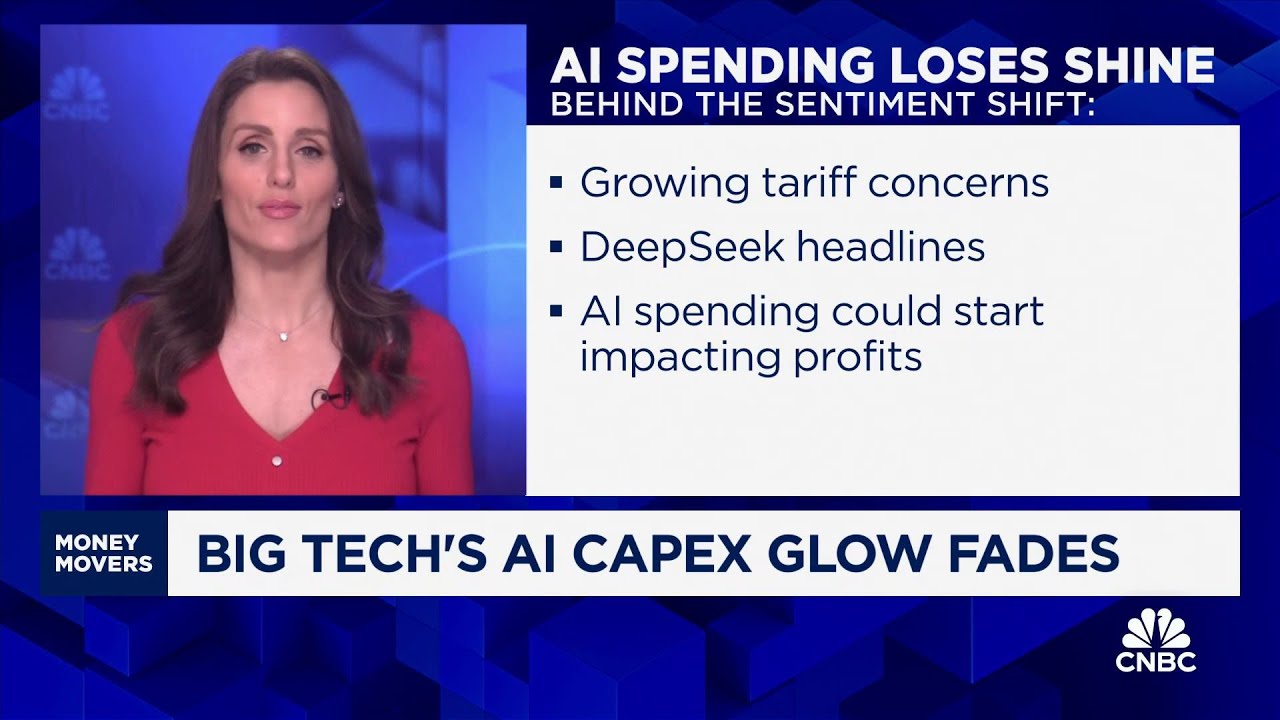

Analysts attribute this market shift to several factors. One major concern is the potential impact of tariffs, prompting investors to seek safer investments, particularly in software. This is reflected in the performance of the IGV ETF, which has seen a 9% increase compared to the SOX ETF over the past month, highlighting a divergence in investor preferences.

Additionally, there are growing doubts about the pace of AI development, leading to skepticism about the immediate benefits of these investments. Bank of America has raised alarms that the substantial spending on AI could begin to erode profits for even the most successful tech companies, often referred to as the “Magnificent Seven.”

The overarching question remains whether this slowdown in investor enthusiasm is a temporary phenomenon or indicative of a more cautious and realistic outlook on AI’s short-term impact on corporate profitability. As the market recalibrates, the focus will likely shift towards demonstrating tangible monetization from these significant investments in AI.