The video highlights Nvidia’s transformation from a gaming hardware company to a leading force in the AI revolution, with its stock potentially reaching $1,000 or more by 2030 due to soaring demand for AI computing power. Despite risks like competition and geopolitical tensions, Nvidia’s strategic importance and expanding role in AI infrastructure could drive its valuation to unprecedented levels, possibly surpassing $20 trillion in market cap.

The video discusses Nvidia’s remarkable stock growth from under $1 in 2015 to over $60 in 2024, emphasizing the potential for its value to reach $1,000, $3,000, or even higher by 2030. It highlights Nvidia’s transformation from a gaming hardware company to a central player in the artificial intelligence (AI) revolution, powering applications like ChatGPT, autonomous vehicles, and global infrastructure. The speaker stresses that Nvidia is no longer just a chip manufacturer but a foundational element of the AI-driven economy, with governments, tech giants, and militaries investing heavily in its technology.

The core of the analysis revolves around Nvidia’s expanding role in AI, particularly in the shift from model training to real-world AI inference, which demands more computational power and more advanced GPUs. As AI models become more complex, they require increased processing tokens, leading to higher demand for Nvidia’s chips. This surge in demand positions Nvidia as a global superpower, with strategic importance for countries like the US, China, Saudi Arabia, and India, all racing to develop or acquire advanced AI hardware and technology.

Financial projections are central to the video’s outlook, with Nvidia’s revenue expected to grow from $10 billion in 2020 to potentially $300 billion by 2030. Applying a modest 20x price-to-earnings ratio, the company could reach a market cap near $20 trillion, making its stock worth over $700 per share. Some experts even suggest that Nvidia’s stock could hit $1,000 per share or more, driven by increasing investments from major banks, governments, and tech firms. The video underscores that Nvidia is integral to the global AI infrastructure, making its future valuation highly significant.

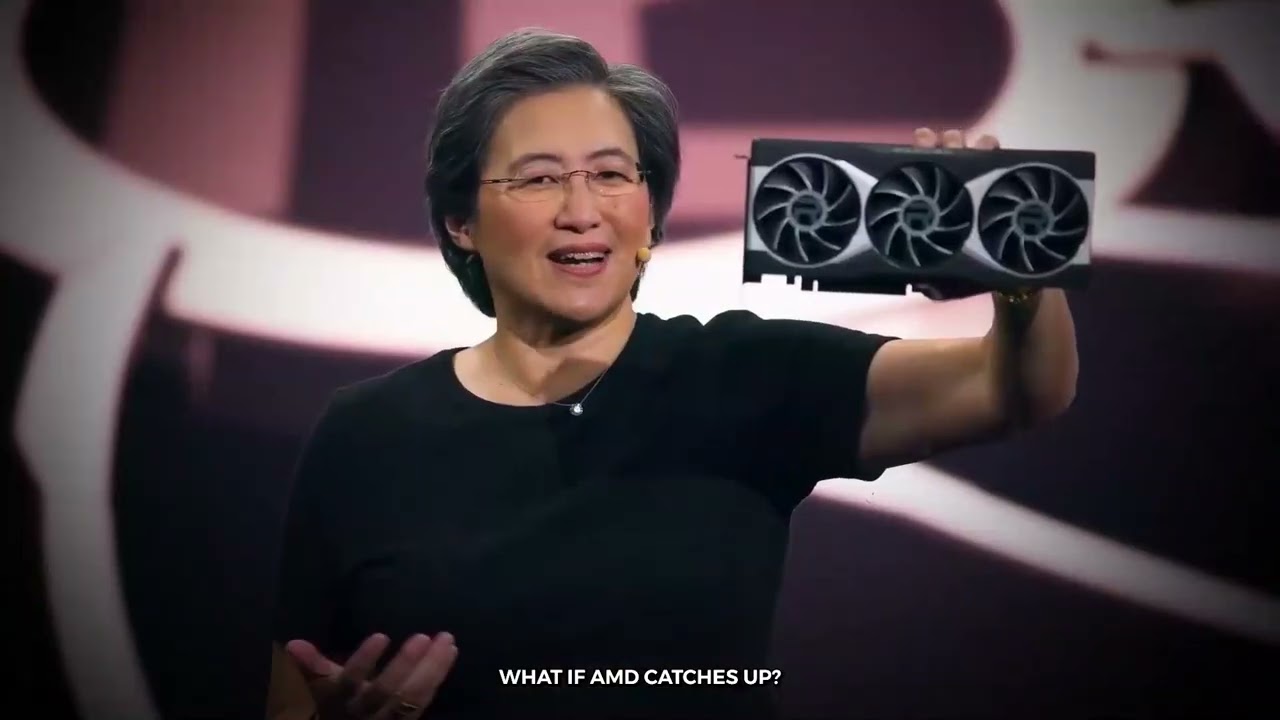

However, the video also acknowledges risks that could hinder Nvidia’s growth, such as potential competition from AMD, geopolitical tensions, and regulatory challenges, especially concerning China. China’s rapidly advancing AI sector and its efforts to develop independent chip technology pose a threat to US dominance. The US-China trade restrictions and export controls could limit Nvidia’s access to key markets, impacting its growth prospects. Despite these risks, the overall sentiment remains optimistic about Nvidia’s leadership and the vast opportunities ahead.

In conclusion, the video emphasizes that Nvidia is at the forefront of a technological revolution that could reshape the global economy. With strong demand, strategic investments, and a dominant ecosystem, Nvidia’s valuation could reach extraordinary levels by 2030. The speaker urges viewers to understand the significance of Nvidia’s role in AI and consider the potential investment opportunities, with some estimates suggesting a price target between $600 and $8,000 per share. The key takeaway is that Nvidia’s future is intertwined with the exponential growth of AI, making it a critical player in the coming decade.