Jim Cramer emphasizes that investors should remain engaged with the AI sector, as it continues to be a key driver of market growth and corporate innovation despite signs of fatigue. He highlights the importance of monitoring how industry leaders like Elon Musk are leveraging AI technologies, particularly in companies like Tesla, to capitalize on future opportunities.

In the video, Jim Cramer emphasizes the importance of not losing interest or becoming complacent about the artificial intelligence (AI) sector. Despite some skepticism and signs of fatigue from investors, Cramer argues that AI continues to be a major driver of market movements, with significant investments and strategic shifts from leading companies. He warns that dismissing AI’s impact could be a costly mistake, as it remains a critical force shaping the economy and stock performance.

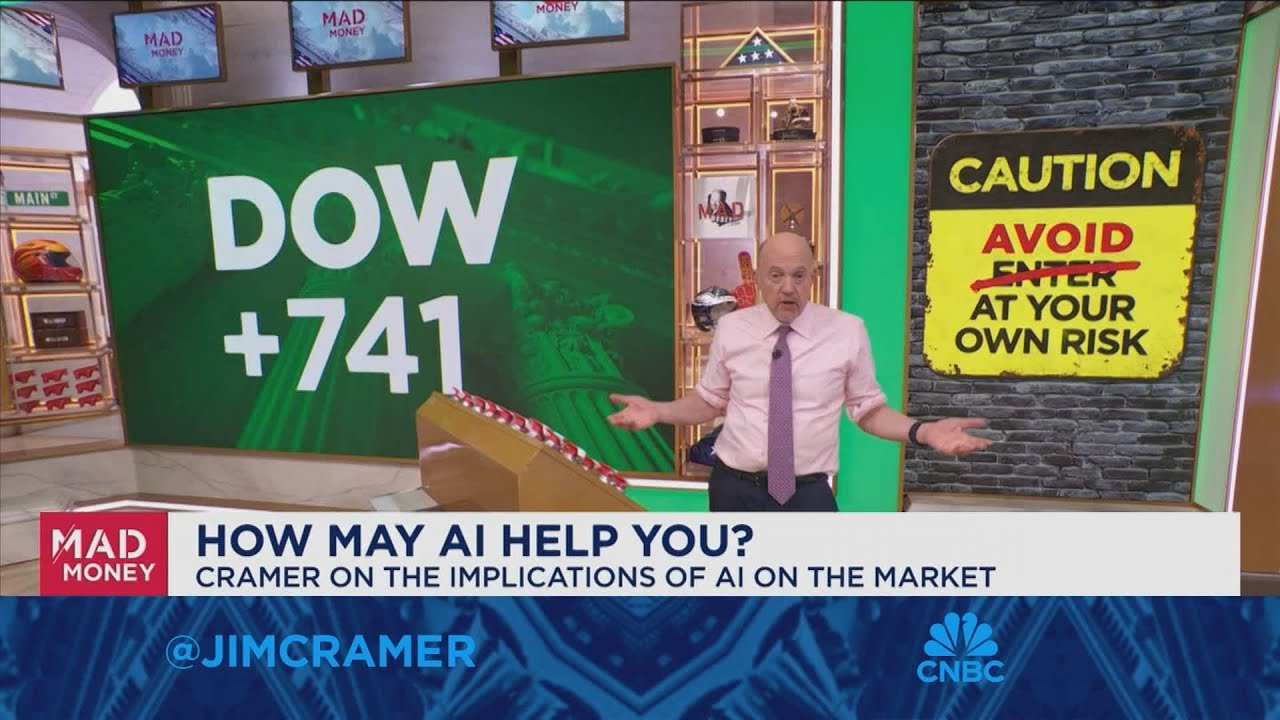

Cramer highlights recent market gains, noting that the Dow rose by 741 points, the S&P increased by 2.05%, and the Nasdaq also saw notable gains influenced heavily by AI developments. He attributes this rally partly to positive economic news, such as strong consumer confidence data from the EU and a more conciliatory stance from President Trump regarding trade tariffs. These factors combined to boost investor optimism and market performance, but Cramer suggests that the underlying AI story is a key driver behind these movements.

He points out that the market’s enthusiasm is not just about macroeconomic indicators but also about how corporate leaders are actively adapting to the AI revolution. Cramer stresses that executives across various industries are continuously integrating AI into their strategies, products, and operations. This ongoing adaptation is crucial for maintaining competitive advantage and driving future growth, making it essential for investors to pay close attention to these developments.

Focusing on Elon Musk and Tesla, Cramer discusses how Musk’s controversial public persona has recently been affecting Tesla’s sales, particularly in Europe. Despite negative headlines and skepticism about Tesla’s sales figures, Cramer suggests that Musk’s influence and the company’s AI advancements—such as autonomous driving technology—are vital components of Tesla’s long-term strategy. He implies that short-term setbacks or controversies should not overshadow the broader significance of Tesla’s AI-driven innovations.

In conclusion, Cramer urges investors to stay engaged with the AI story, warning against complacency or fatigue. He believes that AI remains a powerful force shaping market dynamics and corporate strategies. By paying attention to how industry leaders like Musk are leveraging AI, investors can better understand the opportunities and risks ahead, rather than dismissing the sector as overhyped or unimportant.